Evolution often evokes thoughts of slow, gradual progress — and while that’s true much of the time, there are also periods when change is sudden and dramatic. In these moments, those who assume they have time to act — simply because they always had time to react before — can find themselves caught out spectacularly.

Recognising these moments doesn’t require a crystal ball. Greater awareness of the current state — and how it’s shifting — provides reliable clues as to when and where disruption is likely to strike. This gives those who can see their Landscape clearly a significant advantage over those still playing the game blindfolded.

So, let’s explore five rules of the game that influence the speed of evolution — and consider what they mean for how we should act.

Recognising these moments doesn’t require a crystal ball. Greater awareness of the current state — and how it’s shifting — provides reliable clues as to when and where disruption is likely to strike. This gives those who can see their Landscape clearly a significant advantage over those still playing the game blindfolded.

So, let’s explore five rules of the game that influence the speed of evolution — and consider what they mean for how we should act.

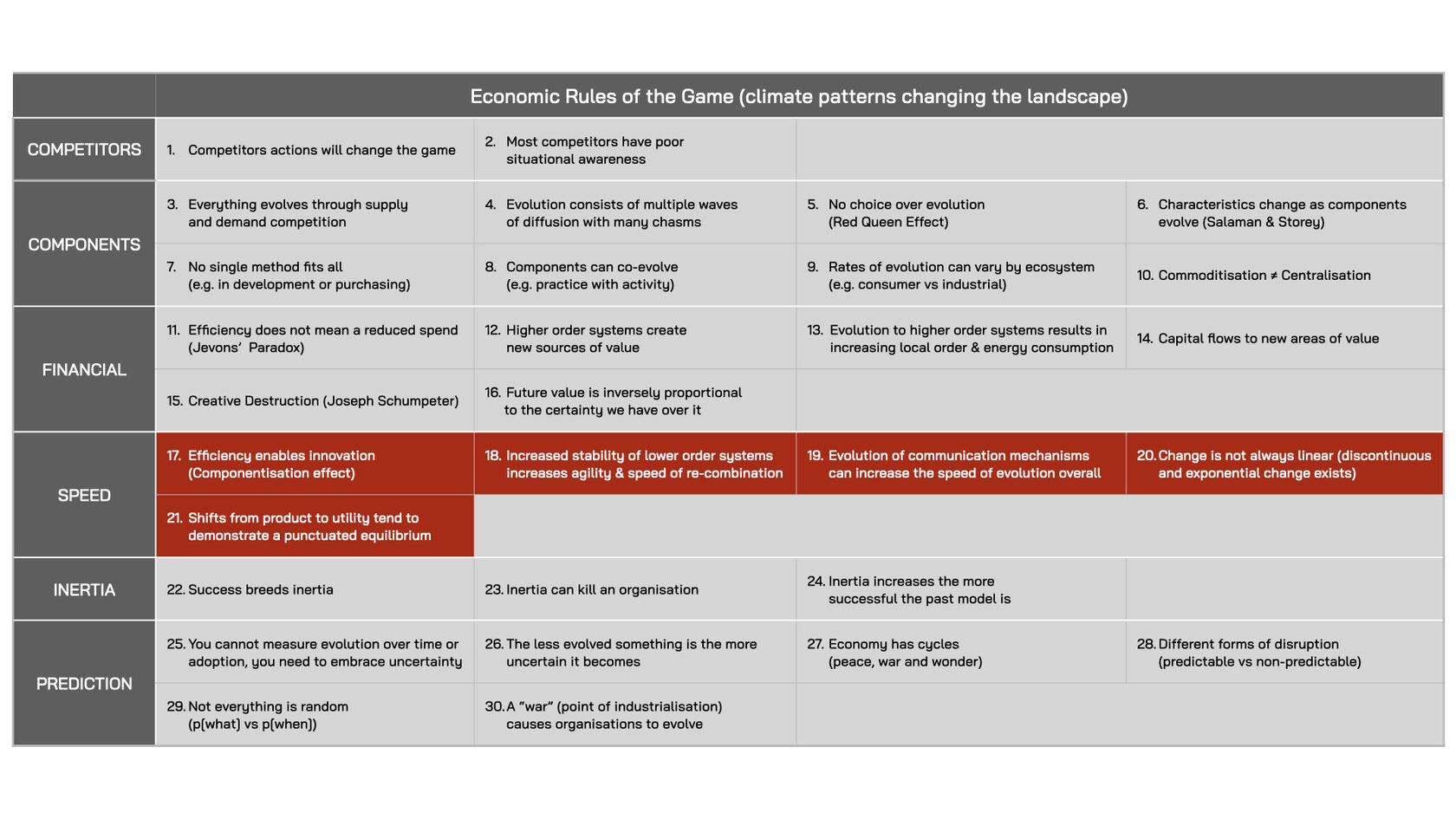

Fig.119: The Of The Economic Rules of the Game On The Speed Of Evolution

Rule #17. Efficiency Enables Innovation (Componentisation Effect)

As noted in rule #4, evolution consists of multiple waves of diffusions with many chasms — which means that ‘time’ and ‘adoption’ are unreliable indicators of how evolved a component is. Therefore, organisations that base decisions on these misleading signals — “let’s wait until more rivals adopt this before we commit to it” — risk being caught out.

For example, the telephone took 64 years to be adopted by 25% of the US population — a level often associated with the ‘tipping point’ — while personal computers took 14 years, and social media just six. Those who waited for social media to be adopted more widely before acting were left playing catch-up to rivals who embraced it earlier and reaped the benefits. The historical tipping points of various technologies that have reshaped our business Landscapes reinforce just how unreliable ‘time’ and ‘adoption’ are as guides for when to act:

• Electricity 1879-1925: 46 years (to reach its ’tipping point’)

• Telephone 1876-1940: 64 years

• Radio 1895-1930: 35 years

• Colour television 1951-1980: 27 years

• Personal computers 1981-1995: 14 years

• Mobile phones 1983-1998: 15 years

• World Wide Web 1989-2000: 11 years

• Social media 2004-2010: 6 years

• Streaming services 2007-2016: 9 years

• ChatGPT 2020-2024: 4 years

However, observant readers will notice that the rate of innovation — how quickly new technologies and ideas reach tipping points — appears to be accelerating. ChatGPT reached 25% of the US population ten times faster than electricity did a century earlier. Why?

The answer lies in the ‘componentisation effect’. As components evolve and industrialise — becoming reliable, efficient platforms with widespread certainty (rule #4) — others begin to use them as building blocks for higher-order systems on (rule #12). As these new systems evolve and industrialise the cycle repeats — with the result being an apparent acceleration in innovation.

For example, we build houses with bricks, copper wiring and plastic pipes — not by starting with a clay pit, a copper mine and an oil well. These components are now industrialised and we don’t need to understand them fully or build them from scratch. We simply use them to build new things. This is how we create new sources of value (e.g. warmer homes, more sustainable buildings) more quickly — because it’s only the higher-order system we need to focus on.

The efficiencies of the past enabling us to build the innovations of the future was described by Herbert A. Simon — a scholar whose work was influential in the fields of economic, computer science and cognitive psychology — as the ‘componentisation effect’. He described how the systems we use are hierarchies “composed of interrelated sub-systems, each of the latter being, in turn, hierarchic in structure until we reach some lowest level of elementary subsystem1”. In other words, everything is built on top of something else.

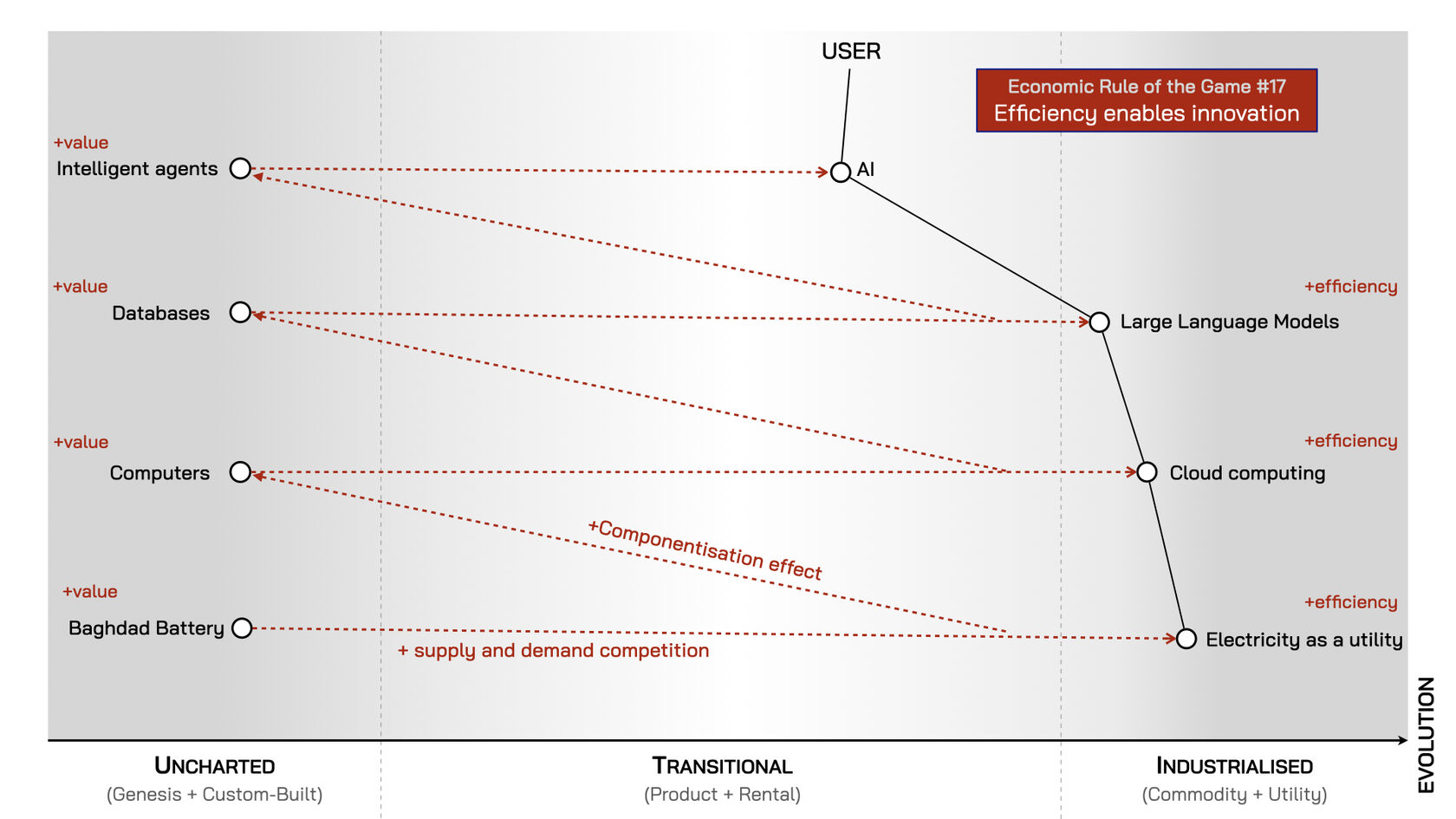

In the case of AI (see fig.120) we can see ‘intelligent agents’ like chatbots built on top of large language models (LLMs), which have themselves become industrialised. LLMs, in turn, are built on top of reliable and efficient cloud computing, which itself runs on electricity as a utility service. Each industrialised component in this hierarchy enables the system above it — and together they create the illusion that innovation is speeding up.

Fig.120: Efficiency Enables Innovation (Componentisation Effect)

In reality, the present is simply being built on the advances of the past — in ever more layered systems. At a certain point, these complex systems of interdependent technologies can create the conditions for the installation of a new technological revolution (as described by Carlota Perez in chapter 22) — ushering in the new industrial age.

We may have reached that point today.

Rule #18. Increased stability of lower order systems increases agility and speed of re-combination

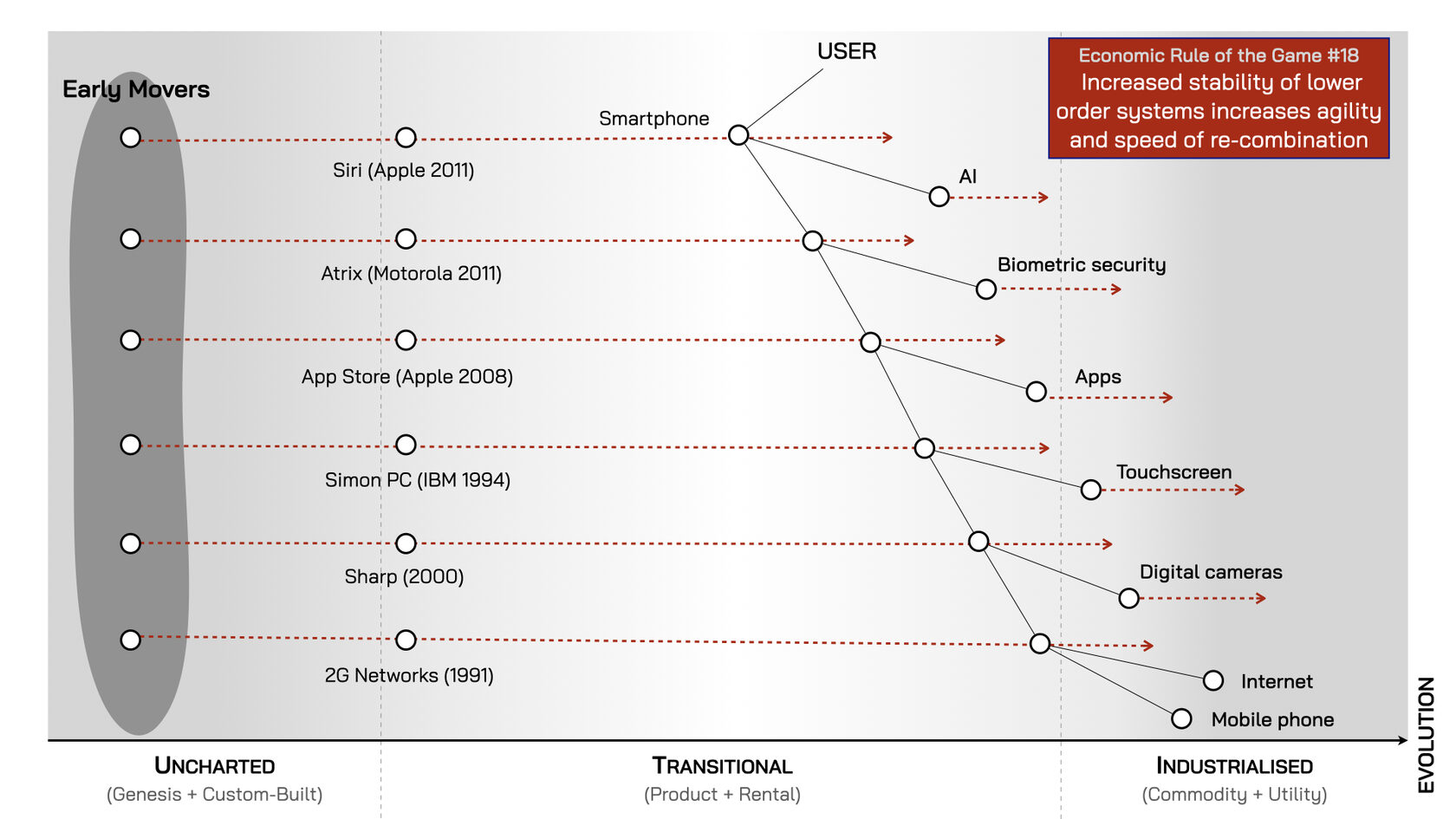

Herbert A. Simon also explained that “complex systems will evolve from simple systems much more rapidly if there are stable intermediate forms than if there are not2”. In other words, complex higher-order systems gain traction in markets more quickly when they’re built on top of industrialised sub-components that already have a high degree of certainty. For example, modern smartphones are a hierarchy of well-established sub-components — such as cameras, processors, internet access and batteries. Combining these into a higher-order system not only satisfies current user needs (e.g. to take pictures and surf the internet) but also unlocked new sources of value (e.g. mobile banking and shopping). The combination of multiple needs being met by one device enabled the smartphone to diffuse more rapidly through markets and evolve.

Today, ever higher-order components are continually and rapidly added on top of this widely-adopted, well-understood system to meet emerging needs (e.g. facial recognition for security, AI integration for productivity). Meanwhile, the system’s underlying components are continually improved to increase efficiency and reliability (e.g. better battery usage), enabling the entire system to do more (new features) with less (energy and cost). These seemingly simple systems conceal enormous complexity. Today, if we want to eat, we don’t have to grow all the ingredients ourselves, or even cook them. Instead, we press a few buttons on our smartphones and a hot meal arrives at our door. But behind this convenience lies a vast, layered network of interdependent systems.

Consider just the supply chains required to grow our food: fertilisers such as potash must be mined using specialised machinery — which itself depends on global supply chains to source raw materials, manufacture components and assemble the equipment. And that’s only one piece of the puzzle. We must also account for the supply chains needed to build the smartphones we use, the ovens required to cook the food, and even the bicycles and motorbikes that delivery drivers use to bring it to us.

Fig.121: Stable Systems Combine To Create A More Useful (And Complex) Higher-Order System

What appears simple on the surface is, in fact, the product of deeply interconnected and industrialised systems — each built on layers of prior innovation. These systems are also continually evolving through the recombination of existing components in new and useful configurations. For instance, the mapping apps used by delivery drivers are generating training data for autonomous delivery robots. Such interactions between humans and machines are embedding our knowledge into the systems themselves, making them more capable of satisfying our needs. However, this also increases our dependency on machines whose complexity is outstripping our ability to understand how they work.

We are the end users benefitting from the innovations of those who came before us — innovations that have become the essential, well-understood components of modern life. We are less the inventors of the new and more the tinkerers of the old, able to reconfigure what already exists quickly and easily. Success now belongs to those whose tinkering best satisfies users’ needs (e.g. to eat — now, here), but the warning signs about our increasing dependency are also there.

Rule #19. Evolution Of Communication Mechanisms Can Increase The Speed Of Evolution Overall

In his book, Diffusion of Innovations (see rule #4 above), Everett M. Rogers defined communication as “the essence of the diffusion process” as it is “the information exchange through which one individual communicates a new idea to one or several others3”. Communication, therefore, is integral to evolution — it spreads understanding of components, including what they are for and how to make them.

Rogers also noted that “mass media channels are usually the most rapid and efficient means of informing an audience of potential adopters about the existence of an innovation — that is, to create awareness-knowledge”4 as they can reach many people quickly. However, it is the “interpersonal channels [that] are more effective in persuading an individual to accept a new idea, especially if the interpersonal channel links two or more individuals who are similar in socioeconomic status, education, or other important ways”.

Social media, which supports one-to-one and one-to-many communication with almost anyone, anywhere on the planet, at virtually zero cost5, plays an oversized role in the evolution of components today. Rogers argued that: “Diffusion investigations show that most individuals do not evaluate an innovation on the basis of scientific studies of its consequences … instead, most people depend mainly upon a subjective evaluation of an innovation that is conveyed to them from other individuals like themselves who have already adopted the innovation”6.

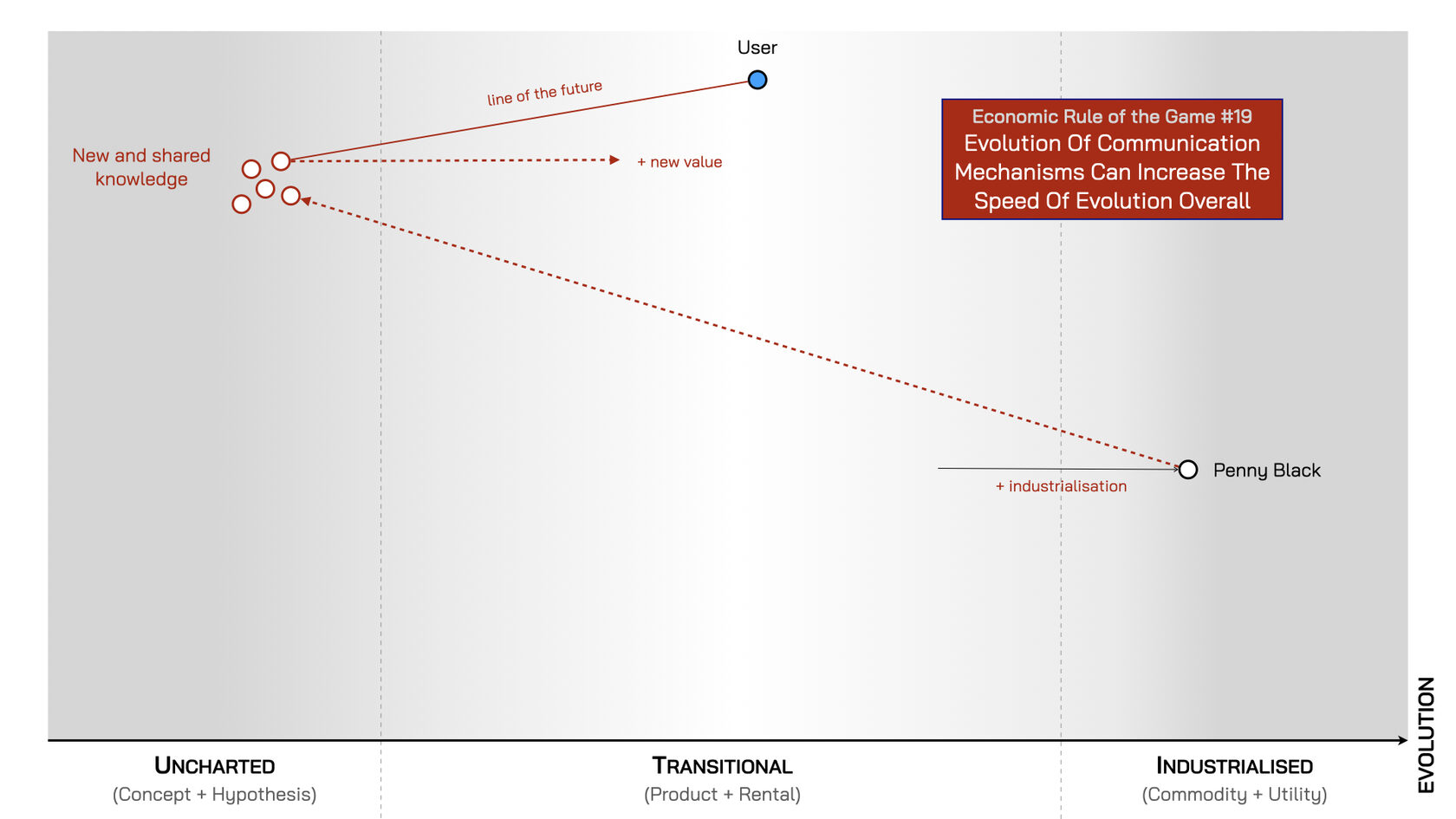

Communication mechanisms therefore — from the printing press to the postage stamp, and from the telegraph to social media — have played an essential role in the acceleration of innovation. These mechanisms enable a wider population to become better informed, more quickly, about the potential benefits of new ideas and activities, as well as spreading certainty about how to make them. The first postage stamp, for example — the Penny Black, issued on May 1, 1840 — played an under-appreciated role in the rise of Britain as an economic powerhouse. When sending letters became a cheap and standardised activity, it led to an explosion in correspondence — from 76 million letters in 1839 to 350 million in 1850. This facilitated a massive exchange of ideas and the creation of new knowledge, which in turn fuelled further technological and scientific advances.

Fig.122: Industrialisation Of The Penny Black Fuelled The Acceleration Of New Knowledge And Ideas

Postal services had existed before the Penny Black7, but it was the industrialisation of this activity that mattered so much. It triggered a spate of copycat services worldwide. The United States introduced its first stamps in 1847, and the volume of mail exploded — from 125 million pieces per year to 4 billion by 1890. The ease with which knowledge and ideas could now spread greatly accelerated the evolution of components. It appears therefore that the more we communicate — the quicker we evolve.

Rule #20. Change Is Not Always Linear (Discontinuous And Exponential Change Exists)

Change is often incremental — a new phone with a slightly bigger screen, better battery or camera — which can lure us into thinking that change is always gradual, occurring in incremental, manageable steps. However, this is an illusion: change can also be sudden and discontinuous, catching out those who believed they would have time to adapt.

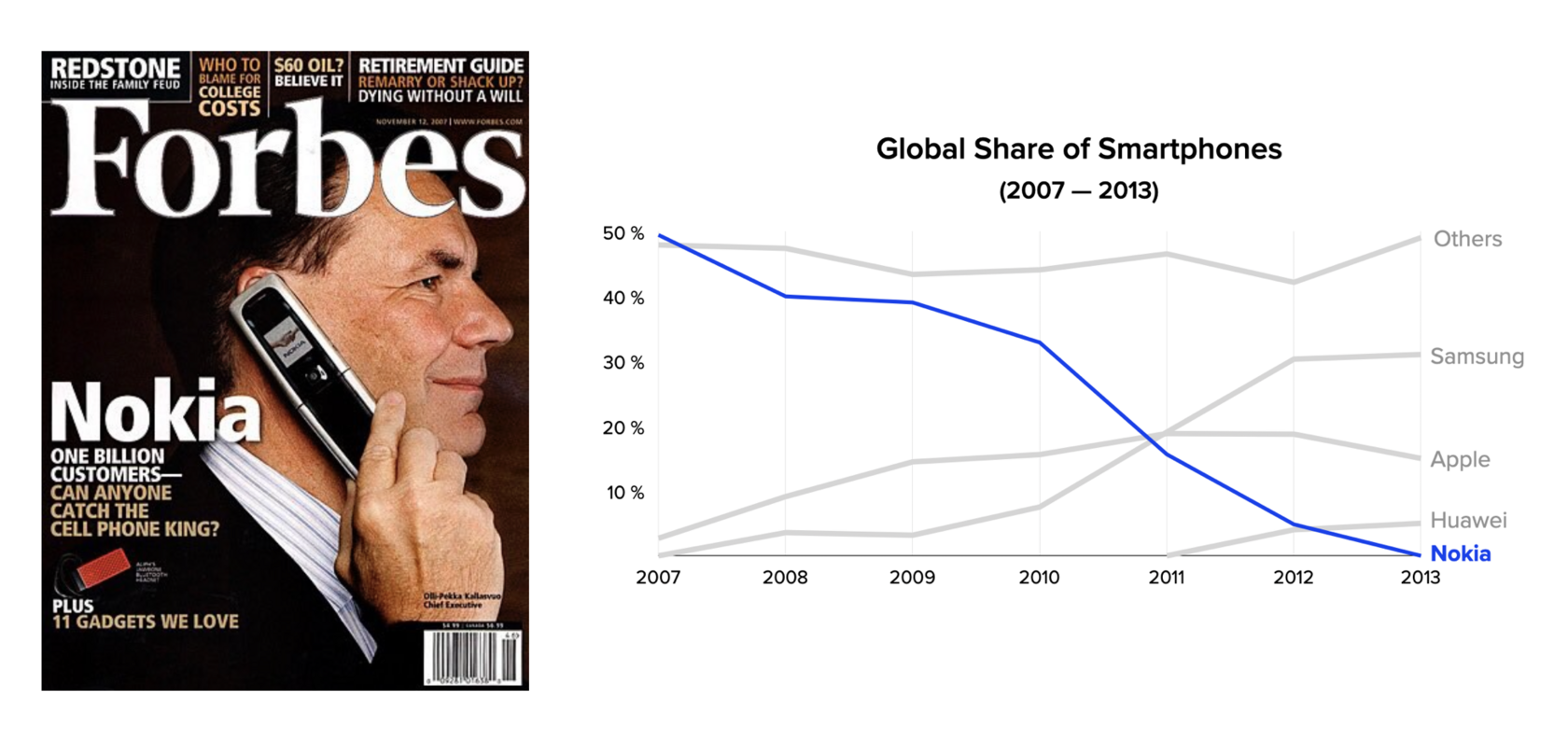

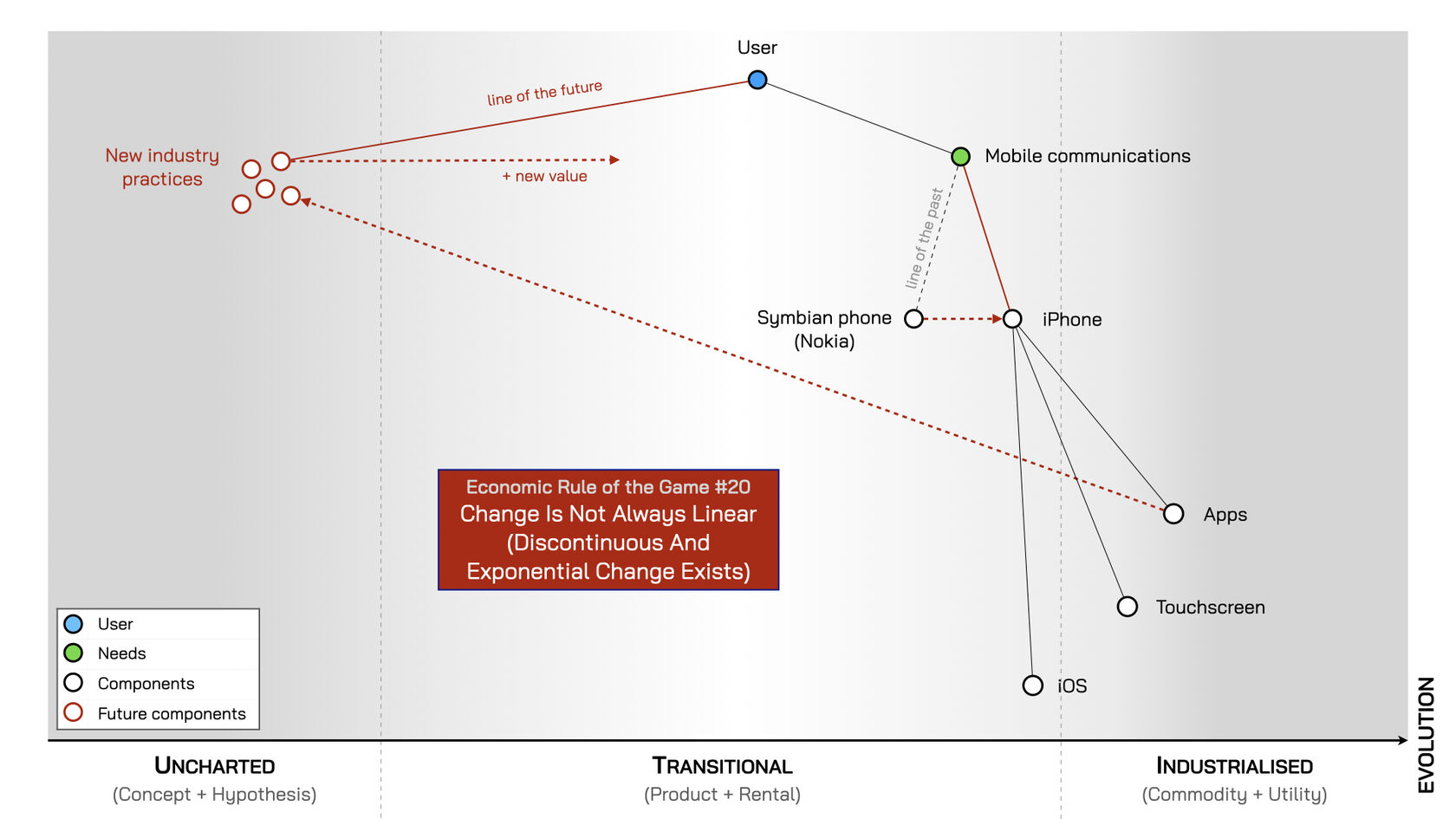

In November 2007, Forbes magazine placed Nokia on its front cover, lauding the Finnish company for having one billion customers and asking the seemingly rhetorical question: “Can anyone catch the cell phone king?”. Yet Nokia’s success — built on a range of devices using its Symbian operating system — had already peaked. Within six years, its share of the global mobile phone market that it had once dominated had collapsed.

Fig.123: “Can Anyone Catch The Cell Phone King?”

New smartphones — with Apple’s iPhone leading the way — introduced touchscreens, customisable interfaces and, most importantly, apps. Apple’s launch of its App Store in July 2008 — which made downloading apps seamless — began to reshape entire industries. Services that had previously been delivered only in person could now be delivered remotely and more efficiently via mobile devices. Rivals who embraced this brave new world not only caught up with the ‘cell phone king’, they surpassed it. Nokia was disrupted by a major discontinuous innovation.

Fig.124: The App Store Triggered The Mobile Revolution

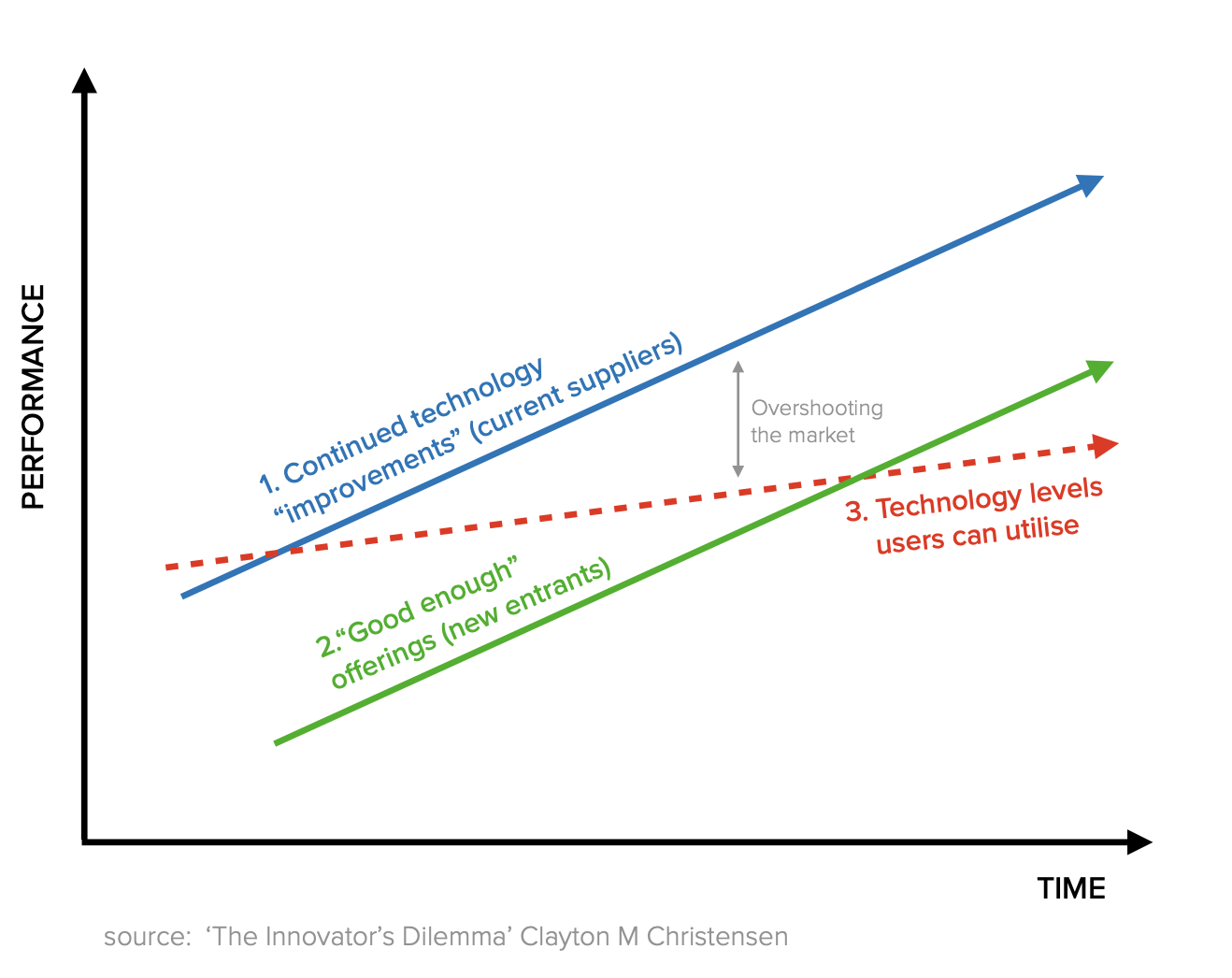

Yet, there has been some debate as to whether the iPhone was truly a case of ‘disruptive innovation’. This was a term popularised by Clayton Christensen in his 1997 book ‘The Innovator's Dilemma’, where he explained that, contrary to popular misconception, it is not the appearance of a superior technology that disrupts a market, but rather the emergence of a simpler, cheaper alternative that captures a niche ignored by market leaders (because it was unprofitable to serve).

As everything evolves (see rule #3), the inferior product improves until it starts to gain broader appeal. This progress is aided by the market leaders who focus on competing with each other by adding more features and complexity — eventually ‘overshooting the market’ by charging customers more for capabilities they don’t need or fully use. At this point, the once-inferior alternative has become ‘good enough’ for most users and better aligned with their needs — so they adopt it. The market has then been disrupted.

Fig.125: Market Leaders ‘Overshoot The Market’ — Allowing ‘Inferior’ Alternatives To Take Their Share

Was the iPhone a disruptive innovation? The answer seems to depend on which market it disrupted — mobile phones or mobile computing. If the former, then the iPhone wasn’t a classic case of disruptive innovation in Christensen’s sense. It was a premium product with new features that represented the next step in mobile phone evolution — not a cheaper or simpler alternative, but a better one (see fig.124).

However, if we view the iPhone as part of the mobile computing market, it does look more like a disruptive innovation: a cheaper, more portable alternative to laptops — albeit one that was initially inferior, with a smaller screen and limited software. Yet, it could be carried easily in a pocket to bag and offered enough functionality for many everyday tasks — all combined with the features of a phone. This gave it a distinctive edge.

Soon, every industry began offering services through apps that met the needs of a growing segment of consumers who wanted access ‘on the go’ or to be ‘always connected’. This triggered disruptive change across multiple industries. While some major players — notably RIM’s Blackberry and Nokia — were swept aside, others adapted successfully, launching their own smartphones and app stores and even outcompeting Apple.

As smartphone sales exploded globally, the sale of laptops peaked in 20118. They later a recovery during COVID — which created demand for studying and working from home that laptops were well-suited to meet. This suggests that while the iPhone’s impact on mobile computing — and many other industries — was transformative, it was more the next stage of evolution of the mobile phone, displacing inferior models from rivals who couldn’t adapt in time (see rule #5), than a classic case of disruptive innovation in either industry.

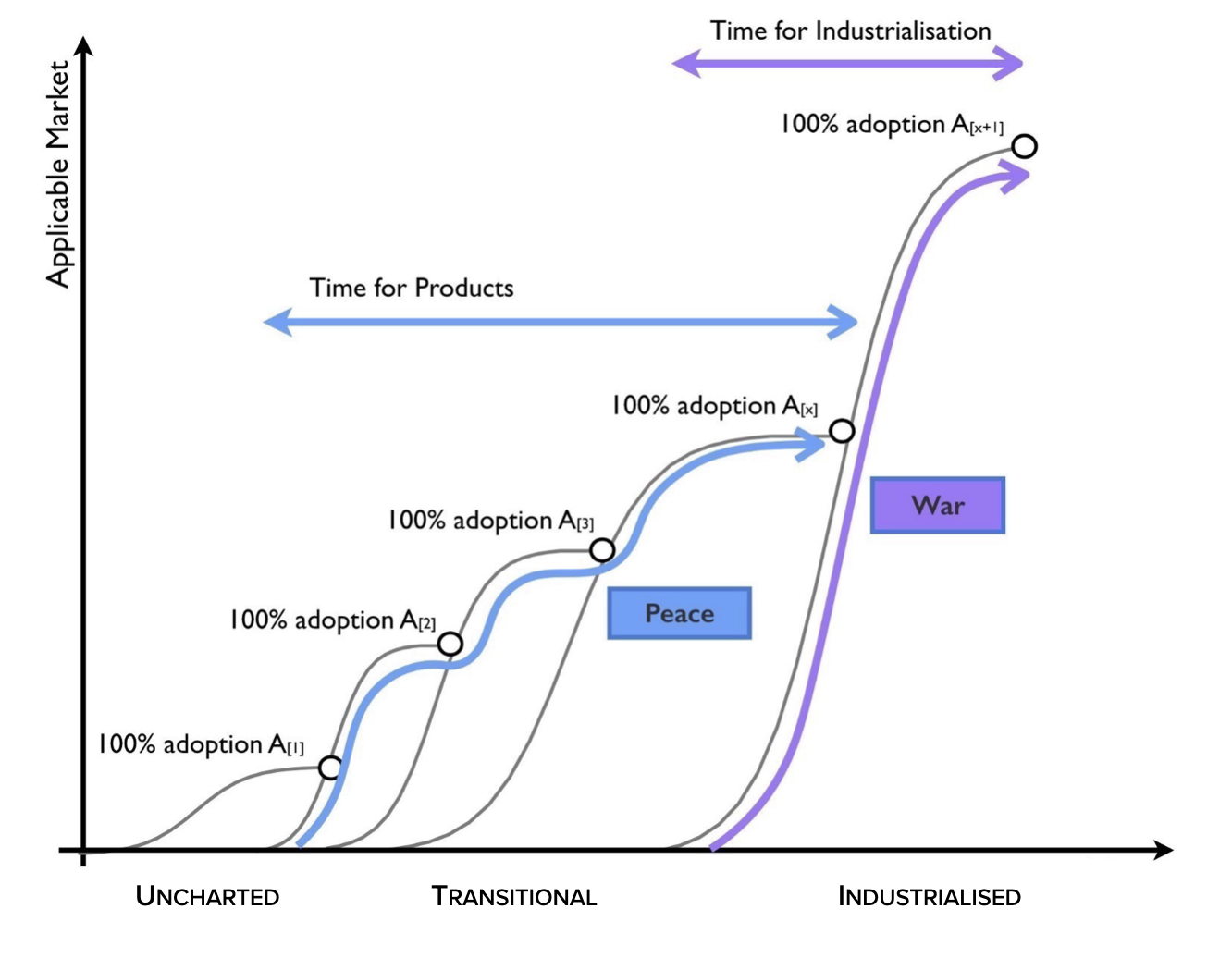

Rule #21. Shifts From Product To Utility Tend To Demonstrate A Punctuated Equilibrium

Discontinuous and exponential change was the focus of a 1972 paper9 by two evolutionary biologists, who posited the theory that while most species spend 99% of their existence in stasis — a state of minimal evolutionary change — these long periods are occasionally punctuated by brief, intense episodes of rapid evolutionary transformation. They called this a ‘punctuated equilibrium’.

Today, organisations are experiencing similar shocks: sudden, rapid changes that abruptly end a long-standing period of stability. One of the most powerful drivers of such disruption is the shift from products to utility-like services — a change that can transform the entire competitive Landscape and destroy those unable to adapt.

As we’ve seen, new components — whether new activities or practices — emerge in the uncharted space on the left of the map. If these components gain sufficient traction, they evolve and move to the right (rule #3). This is the “time of products”, where successive waves of incremental innovations help the product spread to ever-larger markets. This journey can take years, or even decades, lulling industry players — customers, suppliers, analysts — into the false belief that future change will unfold at the same slow, predictable pace.

However, the shift from a “time of products” — a peaceful time with enough profits to go round — to a “time of industrialisation” occurs at an accelerated rate. Those who believe they have time to adapt are suddenly caught out by a transformation that moves faster than expected. By the time they react, this war is already lost.

We touched on this in Chapter Five, where Kodak mistakenly believed they had time to transition to digital photography. But what they failed to foresee was that digital cameras had shifted from being a standalone product to a utility-like component — with multiple digital cameras embedded into every smartphone, meaning customers no longer needed to buy separate devices. It was a punctuated equilibrium that killed Kodak — and the same fate awaits those who cannot anticipate the next major shifts — or fail to recognise that such shifts may not give them the time they think they have to adapt.

Fig.126: Punctuated Equilibrium (Sudden Shift From A ‘Time Of Products’ To A ‘Time Of Industrialisation’)

For example, the release of the iPhone transformed the business landscape as digital disrupted the physical — but not everyone was willing or able to accept that a new game had begun, one radically different from the product-focused game they had been playing before. Previously, success had been about new product features. Now, however, the game was about business model disruption: communication industries shifted from voice-driven to data-driven; retailers shifted from physical locations to being available everywhere, all the time; and entirely new industries — like social media — emerged to take advantage of users who were always connected.

Those who resisted these changes — convincing themselves that no one would bank online (as banking was a relationship business), or that customers wouldn’t buy their products online (as people enjoyed visiting their store and wouldn’t wait around for deliveries) — mistakenly believed they had time to adapt. They assumed that, because the past had evolved slowly, the future would too.

This inertia — resistance to the new — is often strongest among those who were successful during the previous “time of products”. So let’s explore three economic rules of the game that help explain the impact of inertia — and why it can be so fatal.

1 The Architecture of Complexity. Herbert A. Simon. Proceedings of the American Philosophical Society, Vol. 106, No. 6. (Dec. 12, 1962), pp. 467-482.

2 ibid.

3 Diffusion of Innovations. Everett M. Rogers. p19

4 Ibid. p20

5 Of course, costs are not zero as one needs to purchase a digital device, have electricity to keep it powered up, have internet access, which means having some form of infrastructure in place to provide that. However, once this is in place the marginal cost of communication is essentially zero.

6 Ibid p20

7 In fact, the first stamp was the London Penny Post, created by William Dockwra in 1680

9 Eldredge, N., & Gould, S. J. (1972). Punctuated equilibria: an alternative to phyletic gradualism