Strategic planning is flawed1. For a plan to play out exactly as intended, one would need control over all the variables — customer behaviour, competitor actions and market disruptions like new technologies or sudden shifts. In reality, we only have control over our own costs2. This is why, in some organisations, strategy has become little more than a box ticking exercise during the budgeting process — a ritual dance to generate confidence in revenue projections and provide key performance indicators (KPIs) that management can use to monitor outcomes against expectations throughout the year.

Yet other organisations hold strategy in higher esteem and often pay huge sums of money to management consultants to create strategies for them. Their external teams arrive for the ‘discovery stage’ — gathering all available data from inside the company, researching the size of the market, segmenting users and identifying targets. This massive amount of data is poured into PowerPoint templates and spat out as a slide-deck — ‘where quantity has its own quality’ — describing the current state “as is”.

It’s hard for organisations to say ‘no’ at this point. They’ve already spent time — and hundreds of thousands of dollars — on a process that would be wasted if they baulked now. Furthermore, the next stage though is where the “magic” happens. Research (often desktop-based) is conducted into industry “best and next practices” worldwide, revealing the “gap” between the organisation “as is” and what it should aspire “to be”. Options for “closing the gap” — usually three, though one is usually so unfeasible that it leaves a straight choice between two options — are presented, together with a forecasted CAGR (compound annual growth rate) projected far enough into the future to “prove” that either option is a “no brainer”.

The chosen option becomes “the strategy”. A “roadmap” is then created showing who must do what by when to make it real. Organisation-wide OKRs (objectives and key results) or KPIs are then set. Yet, the longer the sequence of moves needed to realise “the strategy” — and the more interdependencies involved — the more likely it is that something will go wrong. “Should the first moves in the planned sequence of events fail to produce the intended effects matters could soon go awry”.3 At this point, the consultants blame the organisation’s people for failing to execute the plan, and try to convince senior management that the organisation needs some kind of “cultural transformation” to fix this — naturally, run by the same management consultants.

But the real problem lies elsewhere. As Robert Burns reminds us: “The best laid schemes o’ Mice an’ Men, Gang aft agley”. Therefore, we need a better approach to strategy than today’s mix of assuming past data can predict the future, or believing that copying what others did somewhere else in the past will help us win here in the future. So, in this final section of looking at the economic rules of the game, we’ll explore how to use patterns to identify what we can predict — and where we must adapt.

Fig.131: Using Climate Patterns to Predict the Future

Rule #25. You Cannot Measure Evolution Over Time Or Adoption, You Need To Embrace Uncertainty

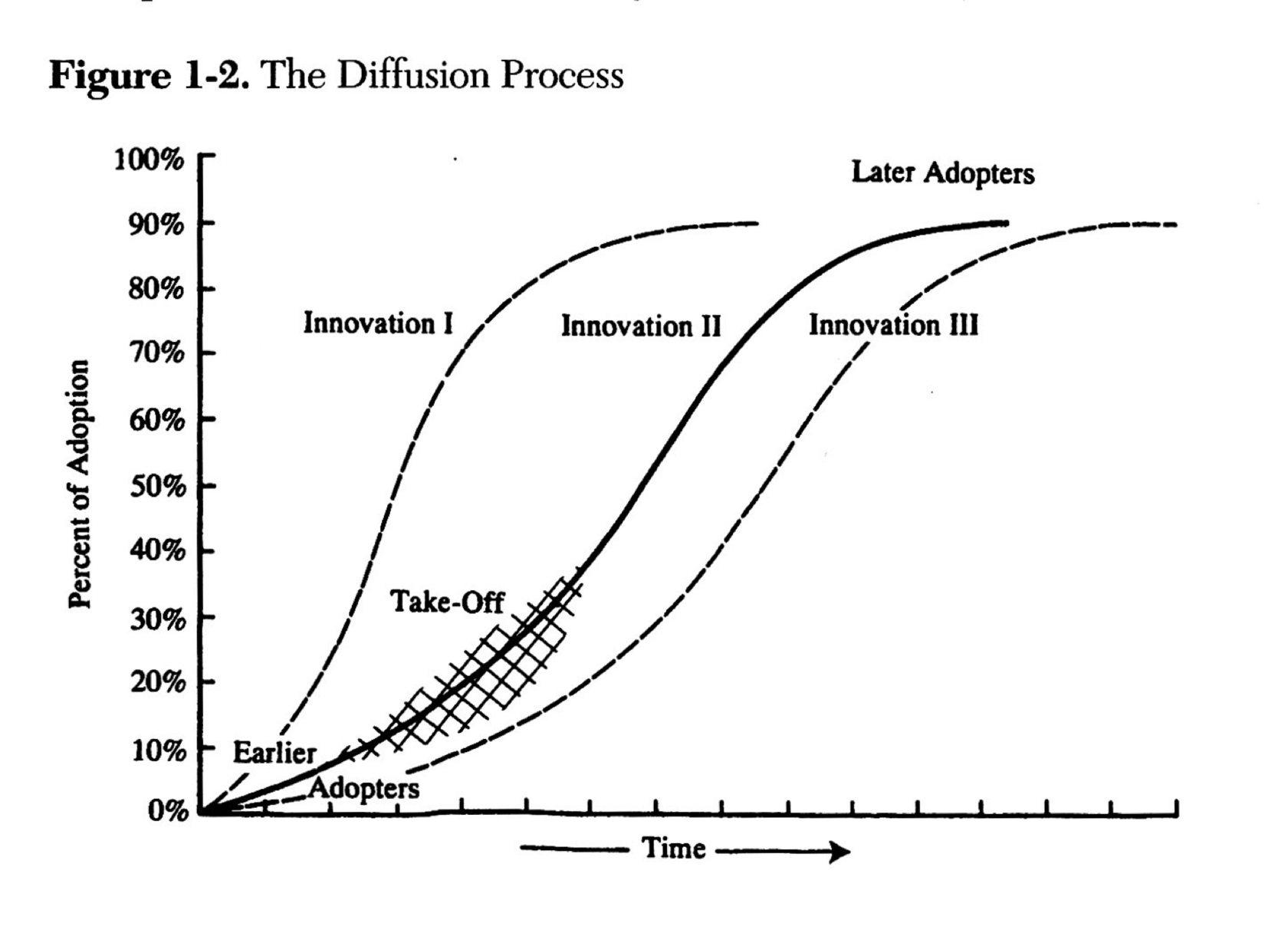

Previously, we looked at Everett M. Rogers’ ‘Diffusion of Innovations’ and how new ideas or technologies spread through a social system (see rule #4). Yet, contrary to the belief “that the obvious benefits of a new idea will be widely realised by potential adopters”, Rogers warned that “most innovations, in fact, diffuse at a disappointingly slow rate4”, as many play a game of ‘wait and see’ — unsure whether the hype is worth acting on.

However, as we’ve also seen (rule #21), the rate of change in an industry can be sudden and dramatic — making ‘wait and see’ a risky game to play, especially if it increases inertia (rule #24) and reduces the organisation’s ability to respond effectively. These risks are exacerbated by the unreliability of time and adoption as metrics — the very measures Roger and Geoffrey Moore explored to identify the ’take off’ point for a new idea or technology, or when it has ‘crossed the chasm’. Rogers appeared to accept the unreliability of time — at least tacitly — as he never added any measurable units to the x-axis (time) on his model (reproduced below), meaning we have no way of knowing whether the ‘take off’ point is reached in months, years, or decades — except in hindsight.

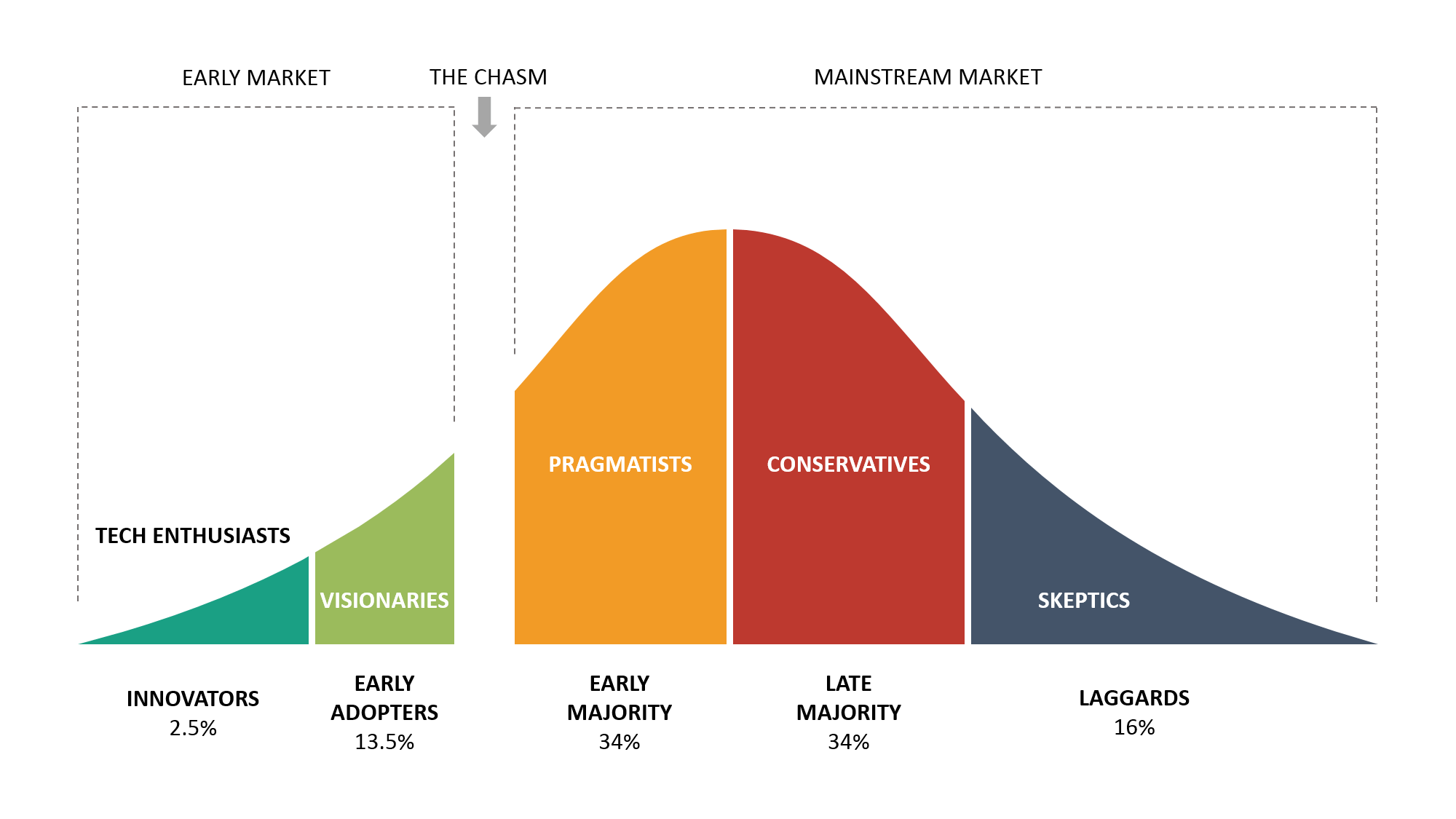

Likewise, Moore’s ‘adoption curve’ (reproduced below) is also a flawed guide for deciding when to adopt new ideas or technologies.

To illustrate this, consider the question: At what percentage level of adoption should a component be considered a commodity — in other words, something that can no longer be differentiated except by price and availability (i.e. branding or new features won’t convince you to pay more)? Maybe you said 50% or 75% of the population? But now consider this: gold bars are widely regarded as a commodity, with price determined purely by weight and purity — yet very few people own gold bars.

Conversely, considering the loudly expressed preferences for certain brands and the discussions about new features of the latest models in the media, it seems that few consider smartphones to be a commodity. Yet, in many markets, almost everyone owns a smartphone and, in some markets, there are more smartphones in circulation than people. So how can something adopted by everyone not be a commodity (smartphone), when something accepted as a commodity is owned by very few (gold bars)? Adoption — like time — is not a reliable measure for determining whether to adopt the new. We need something else.

Everett Rogers himself hinted at what this ‘something else’ might be. He described technology as an activity that, “reduces the uncertainty in the cause-effect relationships involved in achieving a desired outcome5”. What drives diffusion, therefore, is an increase in certainty about the new and what it can be used for. Geoffrey Moore also recognised the role of certainty in his model. The gaps between different groups — for example, between early adopters and the early majority — exist because the latter have more uncertainty about the usefulness of the new than the former, who have already resolved this for themselves.

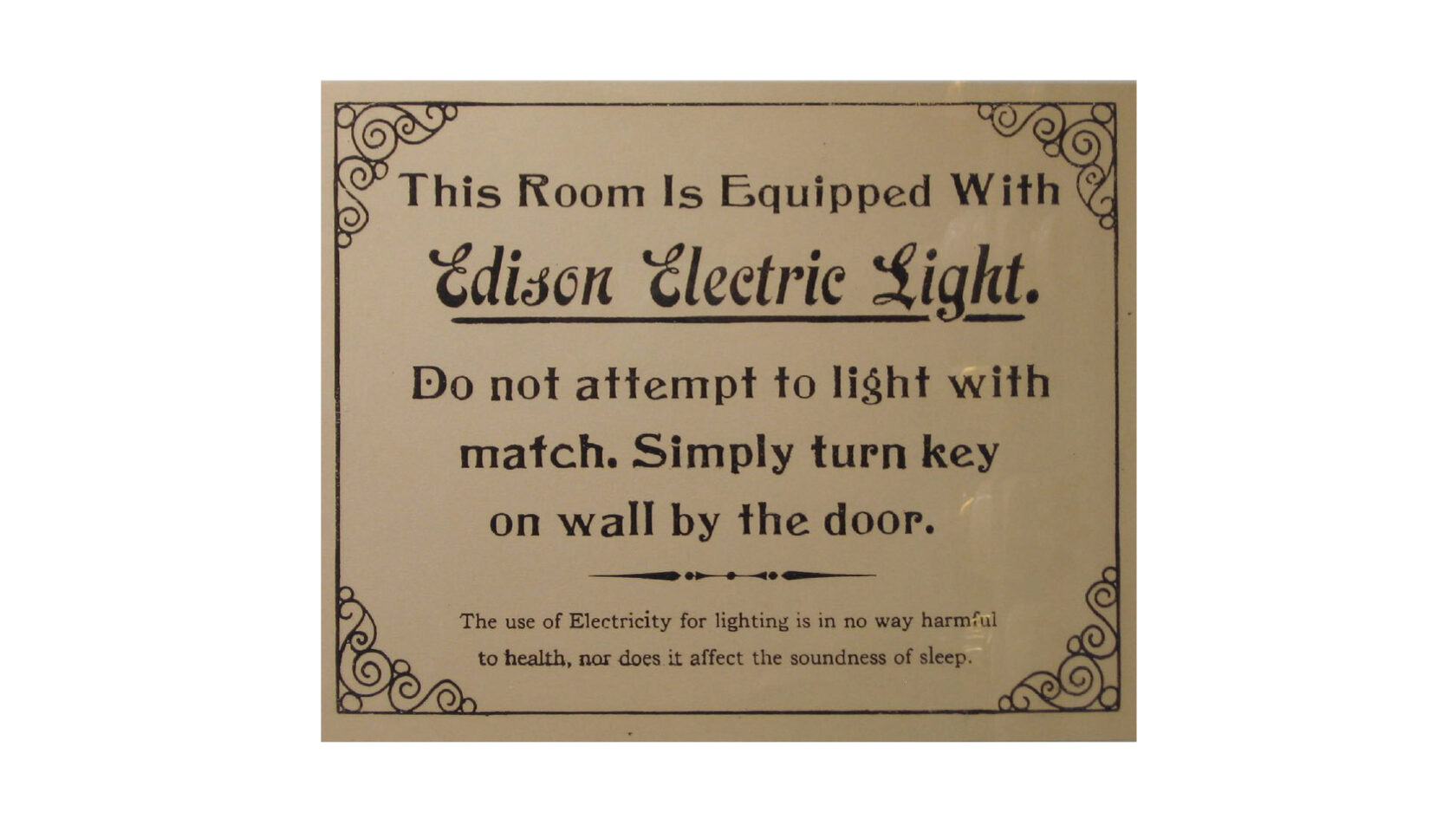

‘Pragmatists’ — those on the right hand side of the chasm — gradually gain certainty through marketing material, or information shared at conferences or in trade media. This wider communication about the benefits of the new is how we develop and spread certainty. For example, when electric lighting was first used in hotels, posters went up in hotel rooms explaining how to use it (see fig.132); while early telephones came with user manuals explaining which way round to hold the receiver and how loud to talk (fig,133).

Therefore, certainty — not time or adoption — may be a more reliable guide for when we should embrace the new.

Fig.132: Increasing Certainty About Electric Lights

Fig.133: Increasing Certainty About Telephones

Certainty is how we measure the evolution — or the changing nature of components — on a Wardley Map6. Everything we do, and how we do it, is evolving (rule #3), which drives every component to the right of a map, towards ever-greater levels of industrialisation, where it becomes impossible to differentiate components — now commodities — except by price and availability. The point of industrialisation occurs when there is widespread certainty amongst users about what the component is for, and widespread certainty amongst suppliers about how to provide this efficiently.

Gold bars, for example, have industrialised to the point of being a commodity, where there is widespread certainty about what they are (purity) and what they’re used for (storing value). We can look up the price of gold on any given day to see what it should sell or buy for, and we’re highly unlikely to pay more just because someone has added a fashionable logo. Conversely, smartphones are not (yet) a commodity because suppliers are still pushing the frontier of what phones can be (phone with better cameras or better batteries) and users make subjective choices based on the features that matter most to them. And many are prepared to pay more for a device with a particular logo.

The idea, therefore, that we should wait a fixed number of months or years before adopting a new idea or technology — or wait until at least 25% of the market has adopted it first — is unwise. Time and adoption are not reliable measures of how evolved components are. Some components come with a high level of certainty about them even though only a minority own them (gold bars), while other components may be widely adopted but still carry uncertainty around whether the next iteration will be significantly more useful (smartphones).

Certainty is, therefore, the most reliable measure of how evolved a component is. This means we must embrace a level of uncertainty when adopting new ideas or technologies — or risk getting left behind. Those with the right capabilities may adopt earlier, working through the uncertainty themselves to gain an early-mover advantage. Those who wait too long may find themselves being left behind.

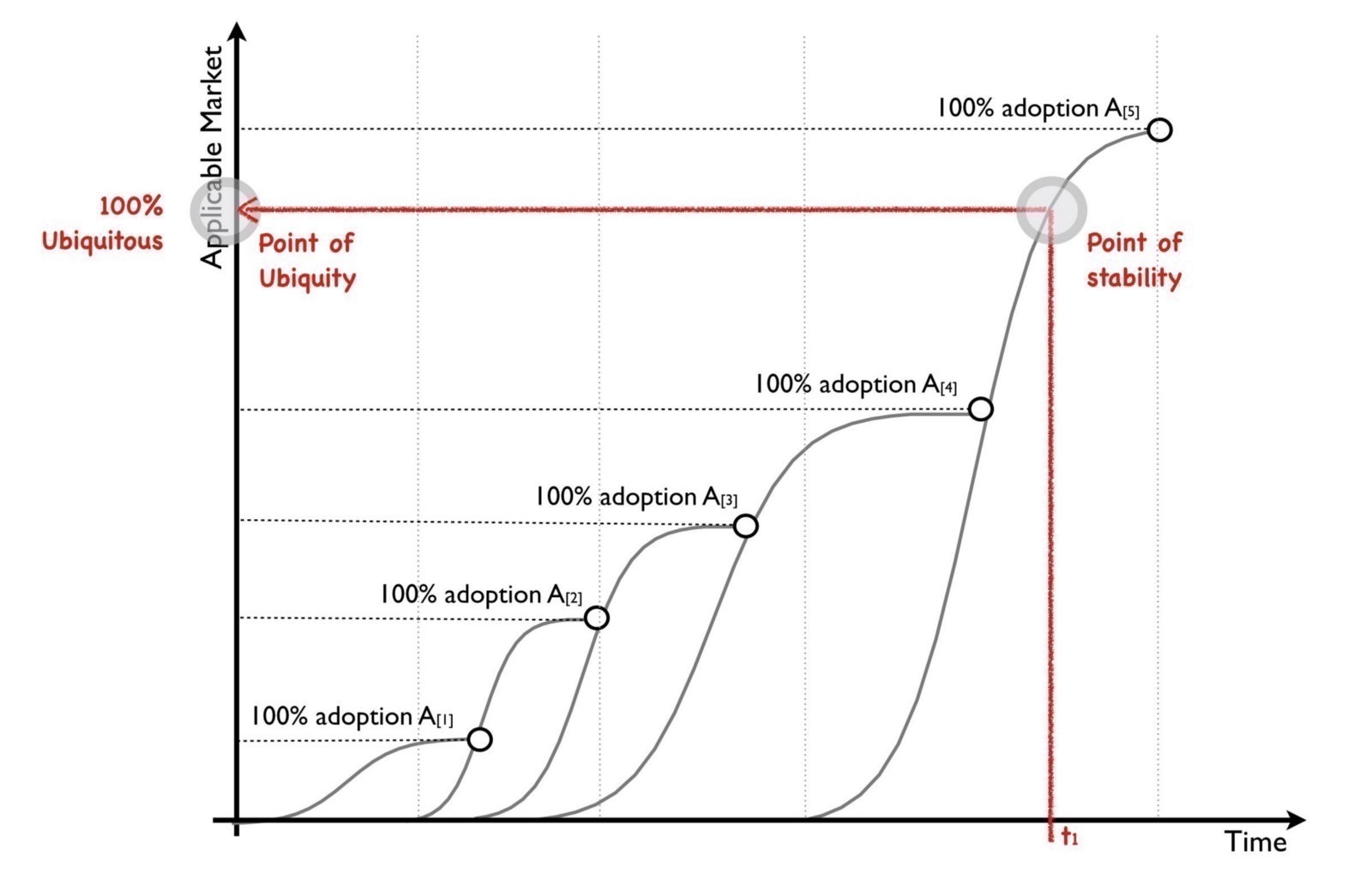

Fig.134: Components Evolve to a Point of Certainty = Ubiquity X Stability (i.e. Industrialisation)

New ideas, practices or technologies may take years — even decades — to evolve from being something novel and uncertain into something widely understood and available in a market. But this is evolution, not diffusion. Each new iteration of a component (e.g. a smartphone) goes through multiple waves of diffusion as it evolves (rule #4), and this evolution towards ever-more certain components can’t be measured by time or adoption. This is why it’s so hard to predict when components will industrialise — becoming commodities that change the game (rule #15). We have to embrace the uncertain, experiment with the new, and learn what it can be used for and how to provide it efficiently. This activity — multiplied across the entire market — is what drives evolution and forces all of us to adapt, eventually, if we want to survive or thrive (rule #6).

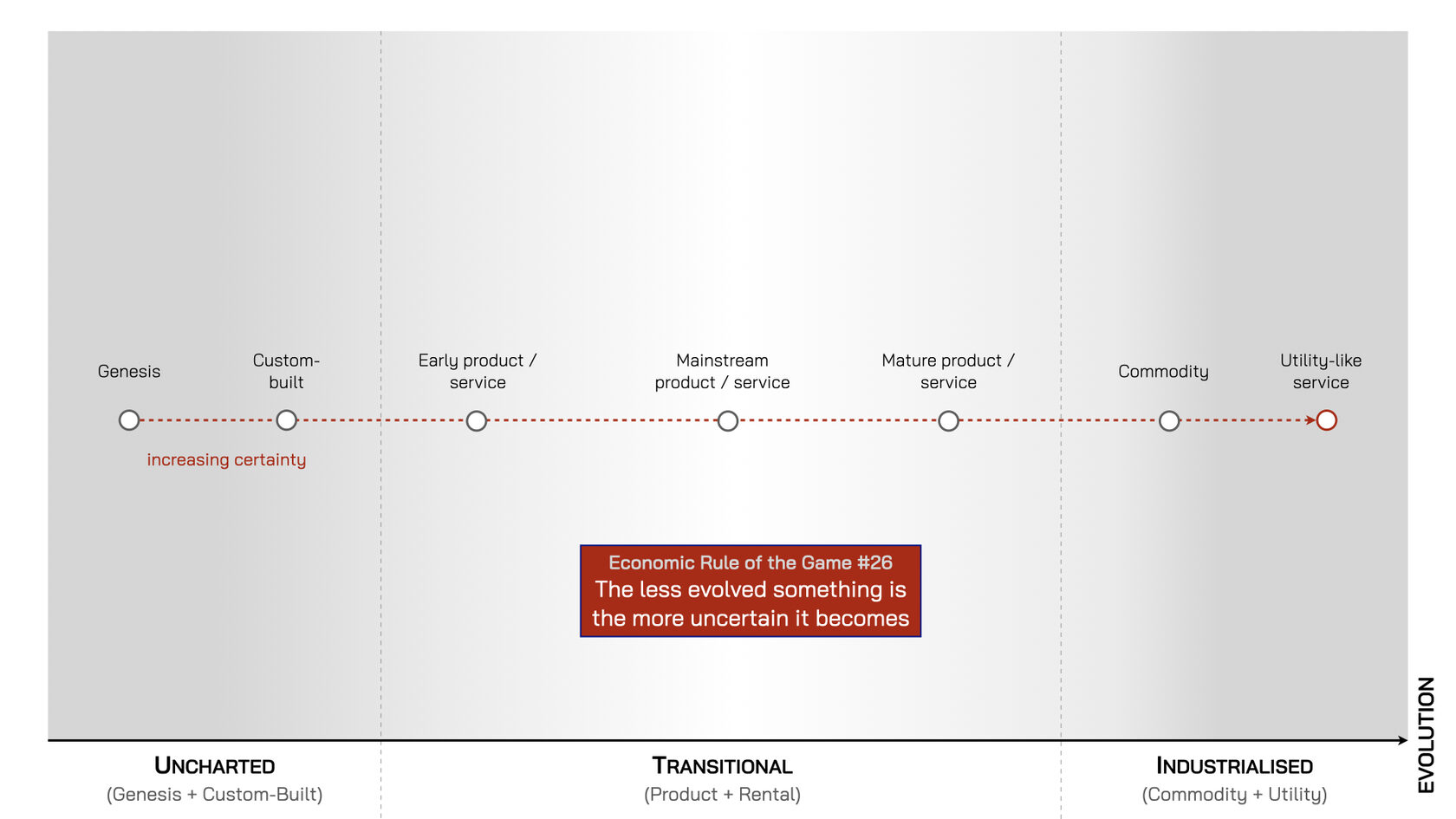

Rule #26. The Less Evolved Something Is The More Uncertain It Becomes

Components on the left-hand side of a Wardley Map have the highest potential future value — but also the greatest uncertainty. If there is demand, a long, prosperous phase may lie ahead, with few competitors at first. But as the component evolves — moving to the right — certainty amongst users about its benefits increases, making the component more valuable, which entices rivals to enter the game.

Initially, competition helps spread the certainty — clarifying what users can expect and which new features the component might support. But eventually, competition exerts downward pressure on prices and, ultimately, profitability. What was once uncertain but potentially lucrative becomes certain and less profitable due to increasing competition.

Therefore, to extract value from a component, one must learn to navigate uncertainty.

Fig.135: The Less Evolved Something Is The More Uncertain It Becomes (and vice versa)

Uncertainty means that, while we know new, higher order components will emerge — built on top of yesterday’s innovations that have become today’s reliable platforms (see rule #12) — we can’t predict in advance which ones will succeed. For every Edison light bulb or phonograph there’s an Edison’s electric pen or Gaugler’s refrigerating blanket that never found demand or created value.

The less evolved a component is, the greater the uncertainty — and the greater the gamble needed to extract value from it. And sometimes gambling doesn’t pay off.

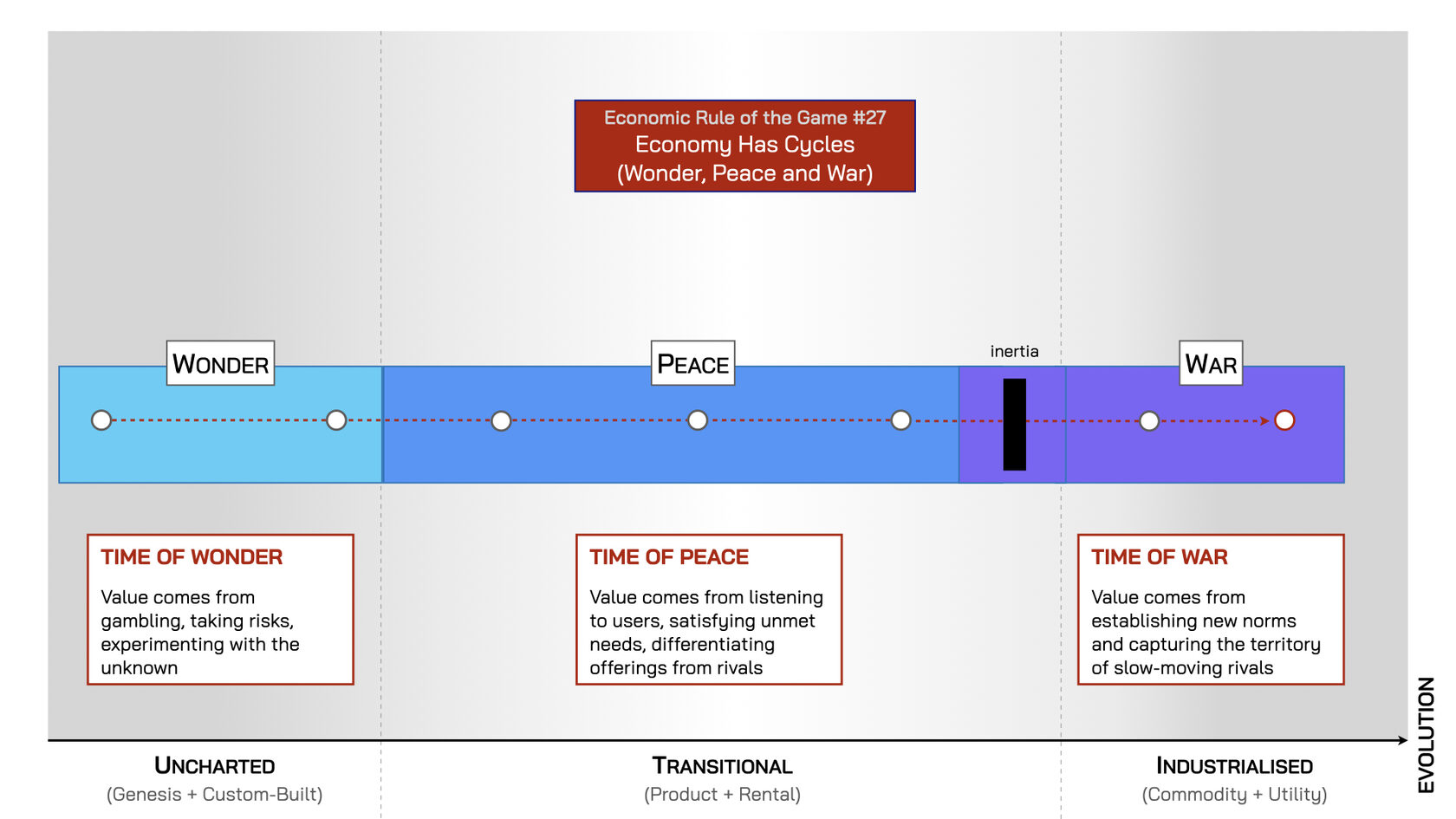

Rule #27. Economy Has Cycles (Wonder, Peace and War)

When new components appear there’s a lot of uncertainty around them as we often don’t know what they’re for, and much remains to be learned about how to build them reliably and efficiently. Many components fail and disappear at this stage. Yet some new components seem to promise the coming of a new age and become a thing of wonder as electricity once was — as was the computer. Today we look at components that carry a high degree of uncertainty, like quantum computing, and wonder how they might reshape the future of industries, economies, or even the world. Therefore, we call this stage of evolution the ‘time of wonder’.

As new components prove their value to users and diffuse across their applicable markets (rule #4), they also evolve — becoming more useful to more users as certainty increases about what they can be used for. This attracts other suppliers, eager to claim their share of profits by launching their own versions with constant feature improvements (rule #3). Some suppliers play this game better than others and become the new dominant giants — like Apple in digital devices or Amazon in e-commerce and cloud computing. These giants shape and drive the market, stimulating demand. There is some disruption along the way, as product improvements help players capture greater share and new rivals emerge to exploit niches left behind by the giants who overshoot their markets (rule #20). Yet it’s the market-making role of these giants that spread certainty and ensure a healthy level of profits for all. We call this the ‘time of peace’.

However, components continue to evolve whether we want them to or not (rule #5). Eventually, all surviving components become industrialised. Electricity — once a thing of wonder — became an essential, everyday component that we hardly think about7 (except during an outage or when the bill arrives) and many users are starting to feel the same about wi-fi today. This transition from products to industrialised components triggers the rise of monopolies, such as state electricity companies, or hyper-scale cloud providers who extract most of the value from the component. The vibrant competition that once drove evolution and applied downward pressure on prices gives way to a small number of players with the scale to dominate the market. This sudden shift (rule #21) often comes as a shock to industry players whose inertia led them to believe the good times would last forever (rule #22). That’s why we call this sudden transition a ‘time of war’.

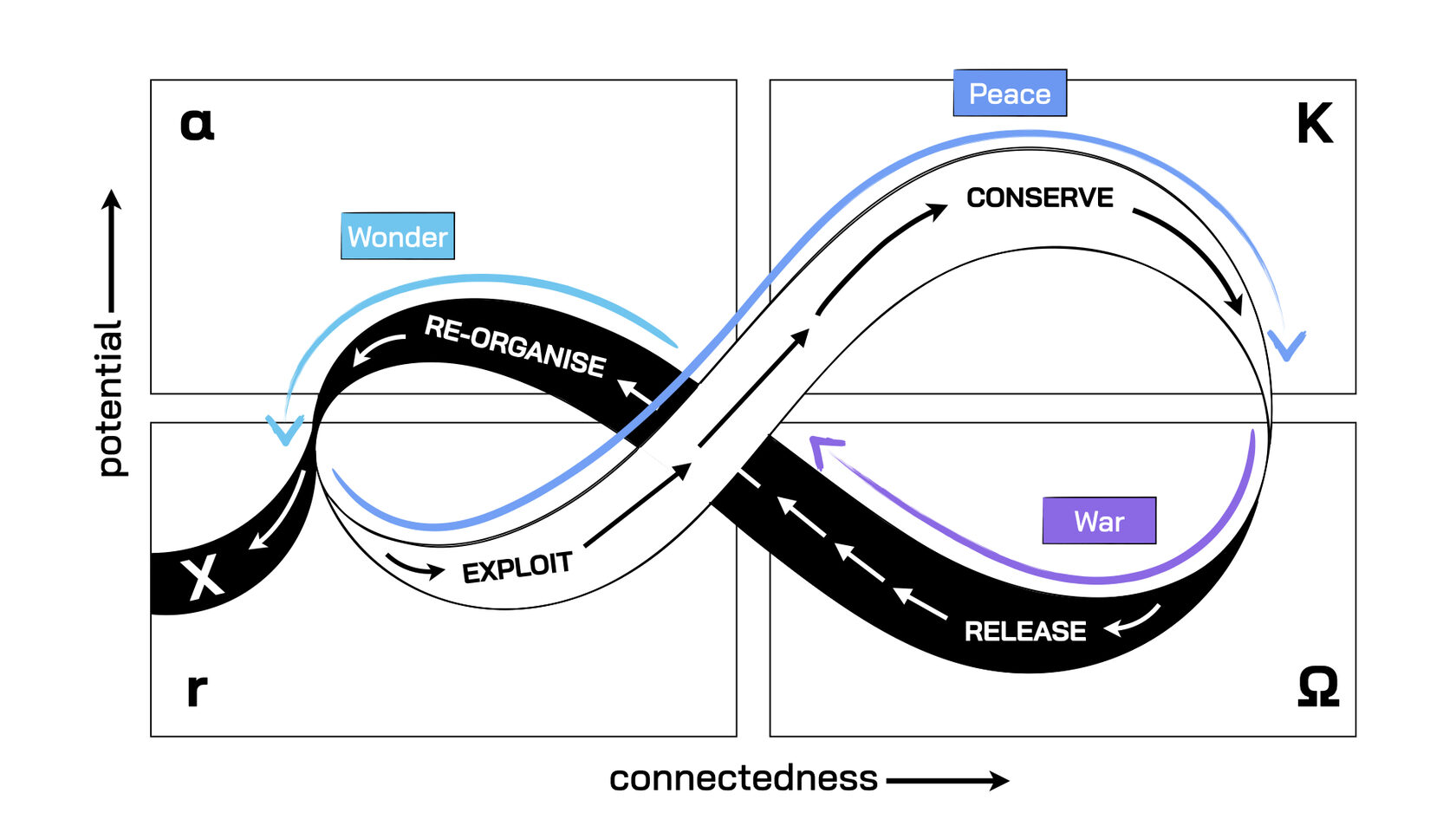

Fig.136: The Times of Wonder, Peace and War

These three phases of wonder, peace and war can be overlaid onto Holling and Gunderson’s Adaptive Cycle, which we first encountered in chapter two (also see fig.137 below). This shows the long ‘time of peace’ in an economy that has formed around a few dominant players in tightly connected supply chains — where the success of one positively influences the success of others. Yet success also breeds inertia (rule #22), fuelled by a huge amount of data from the past to justify hopes that the good times will continue forever (rule #24).

Yet, the seeds of tomorrow’s brave new world have already started to appear, but they’re ignored by those who are successful, viewed instead as unnecessary changes and unacceptable risks. However, the Red Queen Effect (rule #5) reminds us that we have no choice about evolution. The irruption of new technologies — outlined by Carlota Perez8 — triggers a frenzy of capital investment, creating the conditions for the new to take hold.

Fortune now favours the bold, those who move first and sweep up the capital and talent needed to reshape the future. A few contenders engage in a brief but bloody ‘time of war’ in an attempt to capture the most valuable real estate in this coming age, with the victors soon emerging — Ford and Standard Oil in the ‘age of oil, automobiles and mass production’, Intel, Microsoft and the FANGs9 in the ‘age of IT’. Yet a wealth of opportunities remains for those who recognise the potential in the new and can re-organise quickly to exploit new sources of value — while those stuck behind barriers of inertia, desperately trying to hold on to past profits, fail to make the switch in time and die out.

This is the point where technologies and practices, previously stuck in a ‘time of wonder’ and held back by high levels of uncertainty — such as AI agents, quantum computing, fusion energy, or brain-computer interfaces — begin to form the basis for a new industrial age. These eventually become the platforms and knowledge bases on which a new and prosperous ‘time of peace’ emerges, formed around new giants unburdened by the success of the past. Thus, the adaptive cycle continues through phases of peace, war and wonder.

Fig.137: Adaptive Economic Cycles

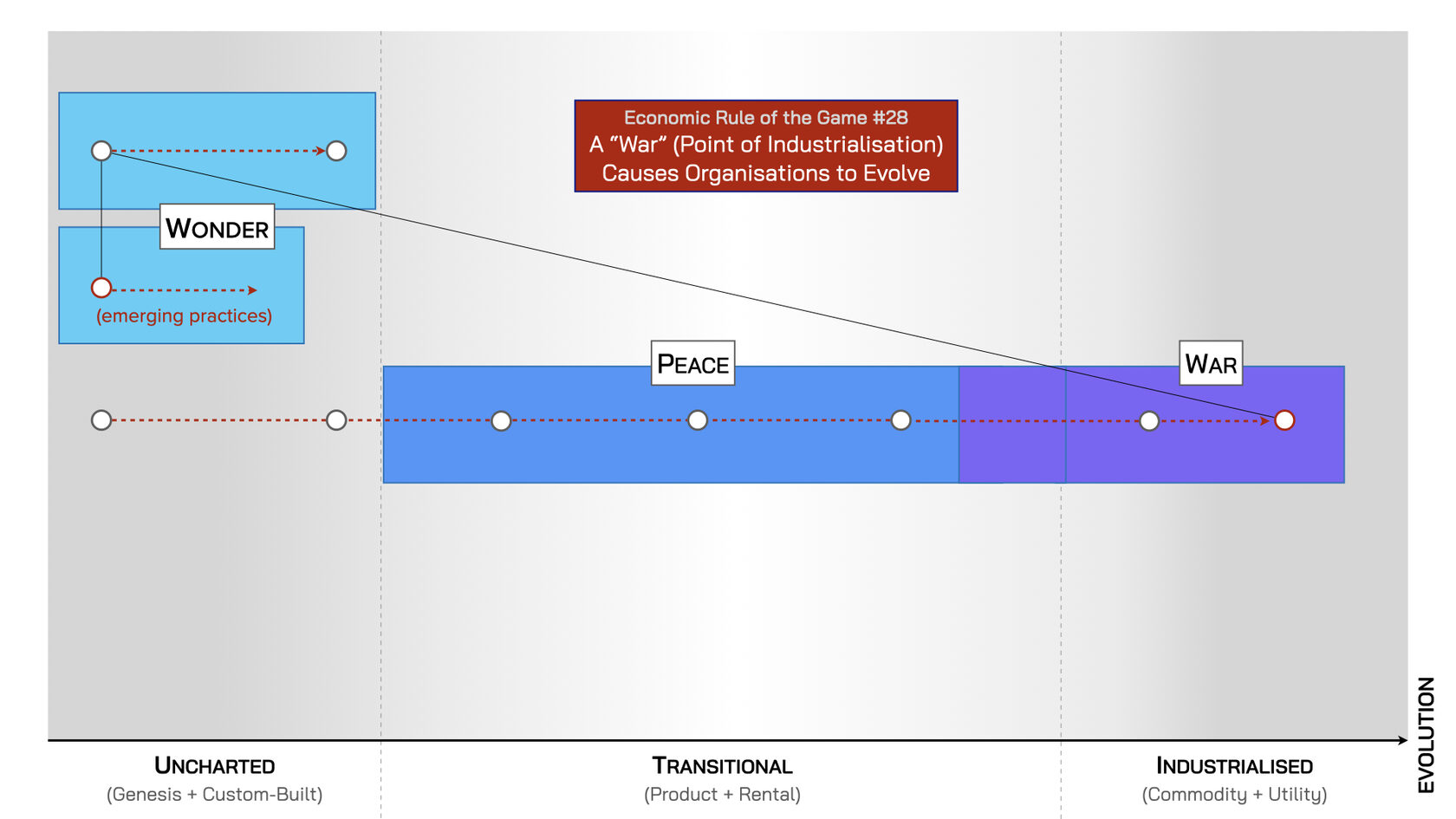

Rule #28. A “War” (Point of Industrialisation) Causes Organisations to Evolve

Most industries enjoy a long ‘time of peace’ of ever-growing customer demand and sufficient profits for all. There is still competition, and some players outperform others, but the loss of a customer is rarely a disaster, as others can be found relatively easily. However, the danger lies in forgetting that everything evolves (rule #3) and assuming this profitable stage will continue indefinitely. Assuming the industry is stable — and that success simply requires repeating past actions — breeds complacency and weakens your organisation’s ability to develop the requisite variety of responses10 needed to adapt to inevitable change11.

Change comes suddenly (rule #21) when a key component industrialises — transforming from an expensive product offered by many competitors into a cheaper, reliable service provided by a new giant with the scale to deter rivals. This shift disrupts the business models of multiple industries simultaneously and can even trigger a new age. For example, the ‘Age of Electricity’ didn’t start with the early generators built by Hippolyte Pixii in the 1830s, but with the victory of Westinghouse’s AC systems that won the ‘war of the currents’ at the end of the 19th century, creating a global standard for electricity as a utility service that changed the world. The importance of such moments — where a key component becomes the platform on which entire industries rework their futures — is rarely obvious at the time. The first commercially available microprocessor, introduced by Intel in 1971, triggered the ‘Age of Information & Telecommunications’, though its true significance was only apparent with hindsight. Yet such changes are monumental.

When a component industrialises, a ‘time of war’ erupts. The battle to become the new standard on which the future will be built is often won quickly by the player who moves first and achieves sufficient scale to make it impossible for followers to dislodge them (think AWS in cloud computing). New, higher-order systems are built on top of these standard platforms (rule #12), and the successful systems attract the capital and talent needed to discover and satisfy emerging demand — accelerating the process of creative destruction of the entire industry (rule #15).

The survival of organisations that believed the good times would last forever is now threatened by their own inertia (rule #23). They often exacerbate their situation with misguided cost-cutting exercises in an effort to retain former profitability: getting rid of underperforming mavericks who could have offered fresh options in favour of those who are successful in the current (but now declining) business model — locking them in deeper to a past that’s fading fast. Inertia also explains why the move from a product to an industrialised component is often made by someone from outside the industry — those unencumbered by past successes or fear of losing what had taken so long to build. The release of a cheaper, reliable Large Language Model (LLM) and AI chatbot by DeepSeek — a company founded only in 2023 and far removed from the hype of investment and profitability narratives in Silicon Valley — fits this pattern.

Fig.138: A War Triggers Change

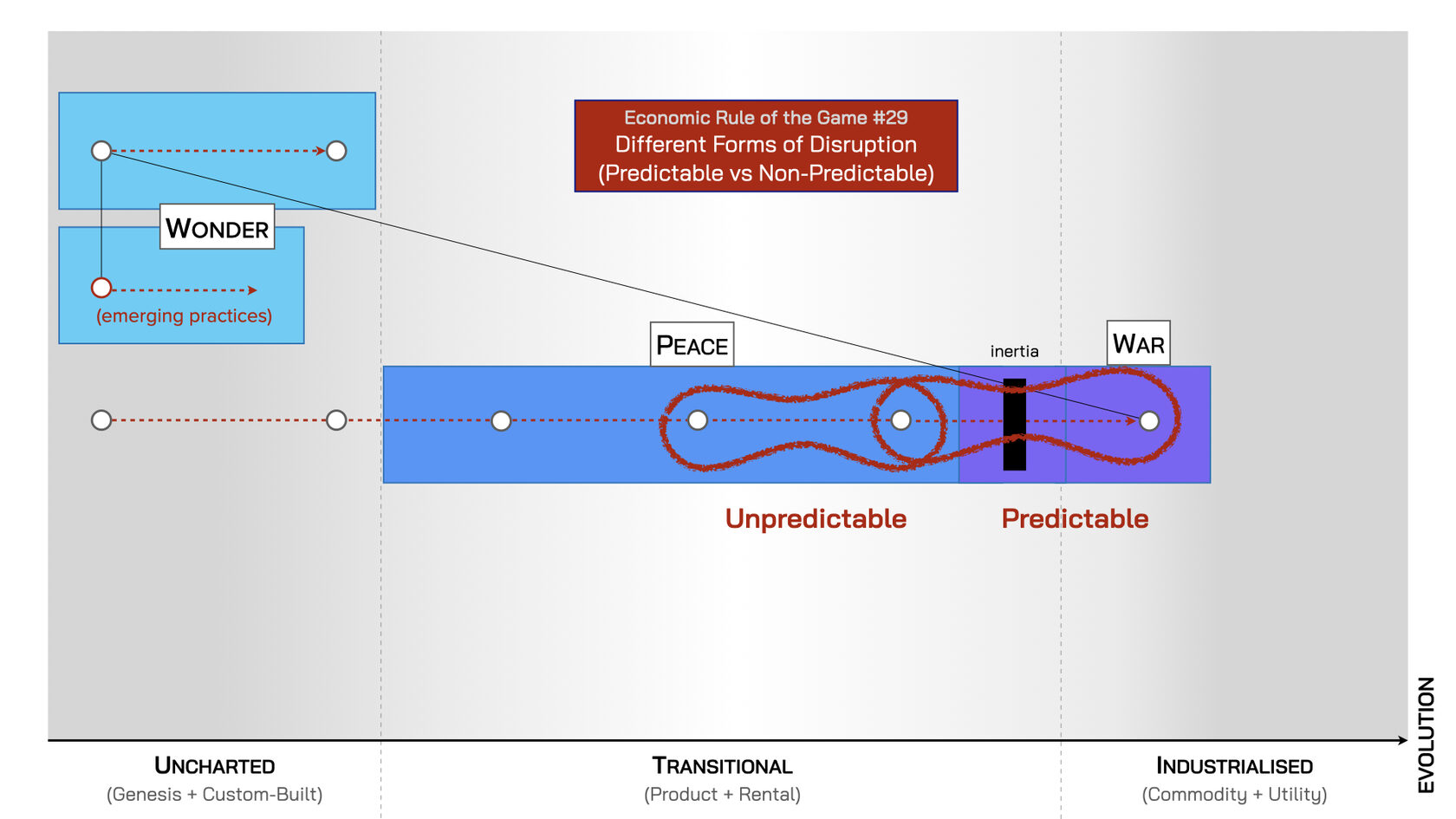

Rule #29. Different Forms of Disruption (Predictable vs Non-Predictable)

‘Disrupt yourself before others disrupt you’ is a popular exhortation to business leaders. Yet disruption, like many words used widely in the business world — such as strategy, innovation and culture — has more than one definition, so we must be clear about what we mean if we are to avoid confusion.

Disruption comes in two forms: unpredictable and predictable. During the ‘time of peace’ disruption comes from the actions of other players on the market who release a better version of the same product that everyone else now has to match. These disruptions are difficult to predict as we can’t say in advance what they will be, who will release them or when (rule #20). The only defences against unpredictable disruptions are to quickly imitate rivals’ offerings, or get even closer to your shared users (and non-users) and identify their needs (including unmet needs) earlier to satisfy them first12.

However, the other form of disruption is entirely predictable. As a product matures and becomes more essential to users, they often start to complain about spiralling costs and declining value for money. For example, as the digital revolution gathered pace in the early 2000s, with organisations needing ever more computing power, finance departments started grumbling about the soaring costs of buying more computer servers, renting additional floor space to host them, paying the electricity bills to keep them cool, and for the network administrators to ensure there were no outages. This was a very profitable time for those selling servers — such as IBM, Dell and HP — as customers had little choice but to keep buying their products to stay competitive. Yet, as we know by now, everything evolves (rule #5).

In 2006, Amazon launched EC2 cloud services, disrupting the server market. Users could now pay only for the computing power they used, all without the burden of forecasting, building and managing capacity themselves. This shift dealt a devastating blow to the industry giants selling servers — despite this change being entirely predictable. In fact, in 2003, IBM admitted they were “pouring resources” into something they called “grid computing” that would provide computing power as a “utility, like water or electricity, which can be turned on and off as if from a tap” (see fig.139).

Yet these giants were stuck behind walls of inertia, too high to overcome (rule #24). They continued selling high-margin computer servers rather than providing users with a more efficient, utility-like service. This left the door wide open for an outsider — Amazon — who had never sold computer servers and so had no attachment to the old ways of doing things (rule #22) — to step in and disrupt the entire industry. And what did the industry giants do in response? Absolutely nothing. Amazon founder Jeff Bezos found it “unbelievable13” that none of them made a move against Amazon for seven years — they simply allowed them to take the future.

Fig.139: IBM’s “Grid Computing” (source: The New York Times 26/01/2003)

Bezos’ incredulity that Amazon faced “no like-minded competition” in cloud computing is understandable when we consider how predictable this type of disruption is. The evolution of an activity from a product to a utility-like service does not have the same mystery to it as the sudden appearance of a product with better features. This evolution is not entirely predictable, but has often been explicitly predicted by many others for many years14. That organisations seem to get caught out by this type of disruption is down to inertia. Organisations therefore should not only learn to see these changes ahead of time — using a map — but need to organise appropriately to be able to overcome inertia and respond to them (this is something the next part of this book is focused on).

Fig.140: Unpredictable and Predictable Disruption

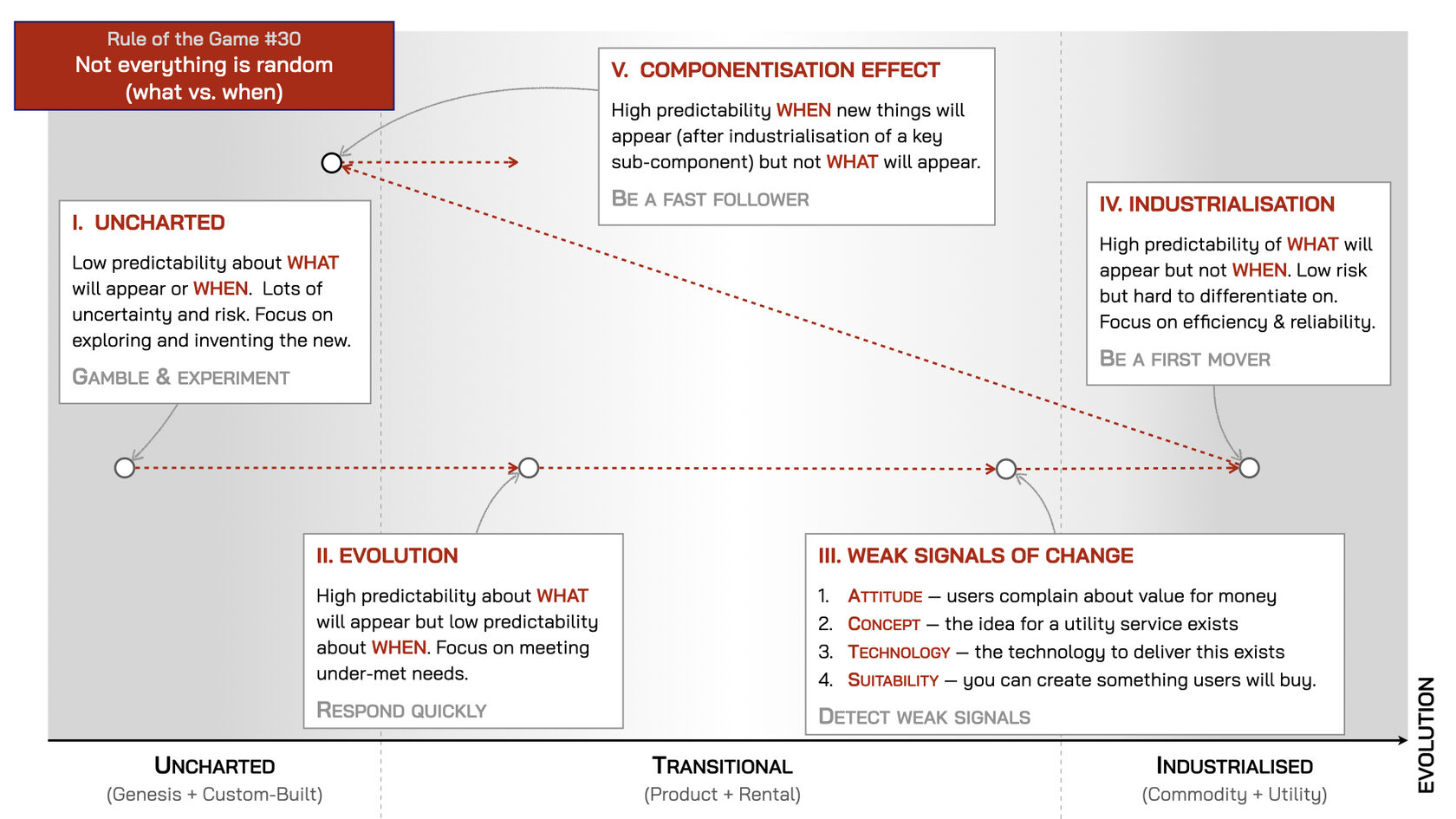

Rule #30. Not Everything is Random

The economic rules of the game demonstrate that, while the future is uncertain, not everything is unpredictable. Sometimes we can say WHAT will appear (e.g. a more evolved instance of the component with greater certainty about its benefits amongst users and its production by suppliers) but we can’t say WHEN these will appear because we don’t know when a particular player will bring these improvements to market.

Equally, we can sometimes say WHEN something will appear (e.g. higher-order systems will appear after a component has industrialised and become a reliable, cost-effective platform on which others can build the new), but we don’t know WHAT they will build, as these activities are new and their experiments could produce a range of different outcomes.

This is the 30th and final economic rule of the game, concerned with anticipating future change.

Fig.141: What v When

1. In the uncharted space on the left of the map, there is always low predictability about WHAT will appear next. This is the space of gambling and experimenting with new ideas, as the potential rewards are at their highest if you’re the first to invent something new the market needs. However, this is also the space where the risks of failure are greatest, as you’re dealing with significant uncertainty.

2. If your component finds demand, it will evolve — but other suppliers will soon enter the market to meet a growing demand you are unlikely to satisfy alone. Now, there is high predictability about WHAT will appear — a product that better meets user needs — but low predictability about WHEN it will appear. Breakthroughs can come from anyone on the market, and it’s difficult to know who is on the verge of one at any given moment. Therefore, the only way we can predict WHEN an improved product will hit the market is if we launch it ourselves. If a rival gets there first, we have to respond quickly if we want to maintain our market share.

3. After a long and profitable ‘time of peace’, products or services start to commoditise — becoming increasingly difficult to differentiate from rival offerings. Here, we can predict WHAT will come next — a utility-like form of the product (such as ‘cloud computing’) — as users find this preferable to continually buying more expensive products (e.g. servers). However, we can’t easily predict WHEN this transition is going to happen (unless we’re the ones making the move), as it depends on a single player launching something suitable. Still, there are ‘weak signals’ that suggest this change is imminent:

2. If your component finds demand, it will evolve — but other suppliers will soon enter the market to meet a growing demand you are unlikely to satisfy alone. Now, there is high predictability about WHAT will appear — a product that better meets user needs — but low predictability about WHEN it will appear. Breakthroughs can come from anyone on the market, and it’s difficult to know who is on the verge of one at any given moment. Therefore, the only way we can predict WHEN an improved product will hit the market is if we launch it ourselves. If a rival gets there first, we have to respond quickly if we want to maintain our market share.

3. After a long and profitable ‘time of peace’, products or services start to commoditise — becoming increasingly difficult to differentiate from rival offerings. Here, we can predict WHAT will come next — a utility-like form of the product (such as ‘cloud computing’) — as users find this preferable to continually buying more expensive products (e.g. servers). However, we can’t easily predict WHEN this transition is going to happen (unless we’re the ones making the move), as it depends on a single player launching something suitable. Still, there are ‘weak signals’ that suggest this change is imminent:

- Attitude: Users start complaining about value for money. Spiralling costs of an essential cost of doing business — such as computer servers once were, or smartphones may be today — suggest that users are ready for a cheaper, utility-like alternative and their inertia may no longer prevent adoption of the new.

- Concept: There’s widespread recognition that this component could be provided as a utility-like service. For example, the idea that computing power could be provided ‘on tap’, like electricity or water, was already widespread at the turn of this century — indicating conceptual readiness, if the technology was viable.

- Technology: Do the technical capabilities exist to turn this product into a large scale, efficient platform? Amazon, frustrated by the need to set up data centres for its own global expansion, had both the incentive and technical capacity to experiment and found a viable solution.

- Suitability: The final signal is whether you can build something reliable and cost-efficient enough that others will switch to it. Amazon understood that if they could build something suitable for themselves, others would adopt it too.

4. The appearance of these weak signals tells us WHAT will happen next — someone will move to industrialise the component, as Amazon did with cloud computing. However, this depends on a player making this move, so it’s hard to predict WHEN — unless you’re the one making it. If you have the resources, this is a relatively low risk move: the component is widely understood across multiple industries (think computing power before 2006), and your offering will reduce costs for customers whilst increasing reliability — giving you a high chance of success. Rivals may attempt to sow fear, uncertainty and doubt to delay adoption, but evolution always wins out: a cheaper, reliable utility service is just too compelling. Eventually, the market shifts.

5. Once the component is industrialised, others will build higher-order components on top of it that create new sources of value (think Netflix, Spotify, TikTok). Here, we know WHEN this happens — now — but we don’t yet know WHAT will emerge. These are novel activities and experimentation is needed to discover what’s possible. This is another ‘time of wonder’ and some organisations choose to be fast followers — letting others take on the early risks, then moving in quickly once demand becomes clear and there’s more certainty about these new components.

5. Once the component is industrialised, others will build higher-order components on top of it that create new sources of value (think Netflix, Spotify, TikTok). Here, we know WHEN this happens — now — but we don’t yet know WHAT will emerge. These are novel activities and experimentation is needed to discover what’s possible. This is another ‘time of wonder’ and some organisations choose to be fast followers — letting others take on the early risks, then moving in quickly once demand becomes clear and there’s more certainty about these new components.

This final rule of the game shows us that not everything is unpredictable. Sometimes we know WHAT will happen. Sometimes we know WHEN something will happen. But rarely do we know both — which is why the future remains uncertain. The only way to discover both WHAT will happen next and WHEN it will happen is to develop sufficient awareness to see the current state and how it’s evolving — then increase your adaptiveness so you can make moves that shape the Landscape to your advantage. Showing how to do this is the aim of the next two parts of this book.

The Economic Rules of the Game

Economies follow recurring patterns of change that can be partially discerned, even if not fully predicted. Yet, the old adage that ‘in the land of the blind, the one-eyed man is king’ reminds us that even a basic understanding of these ‘climate patterns’ — as outlined in the 30 economic models above — can help us anticipate the future and start identifying moves that may shape the shifting Landscape to our advantage.

Let’s recap how these patterns have unleashed change historically and try to use them to anticipate our future.

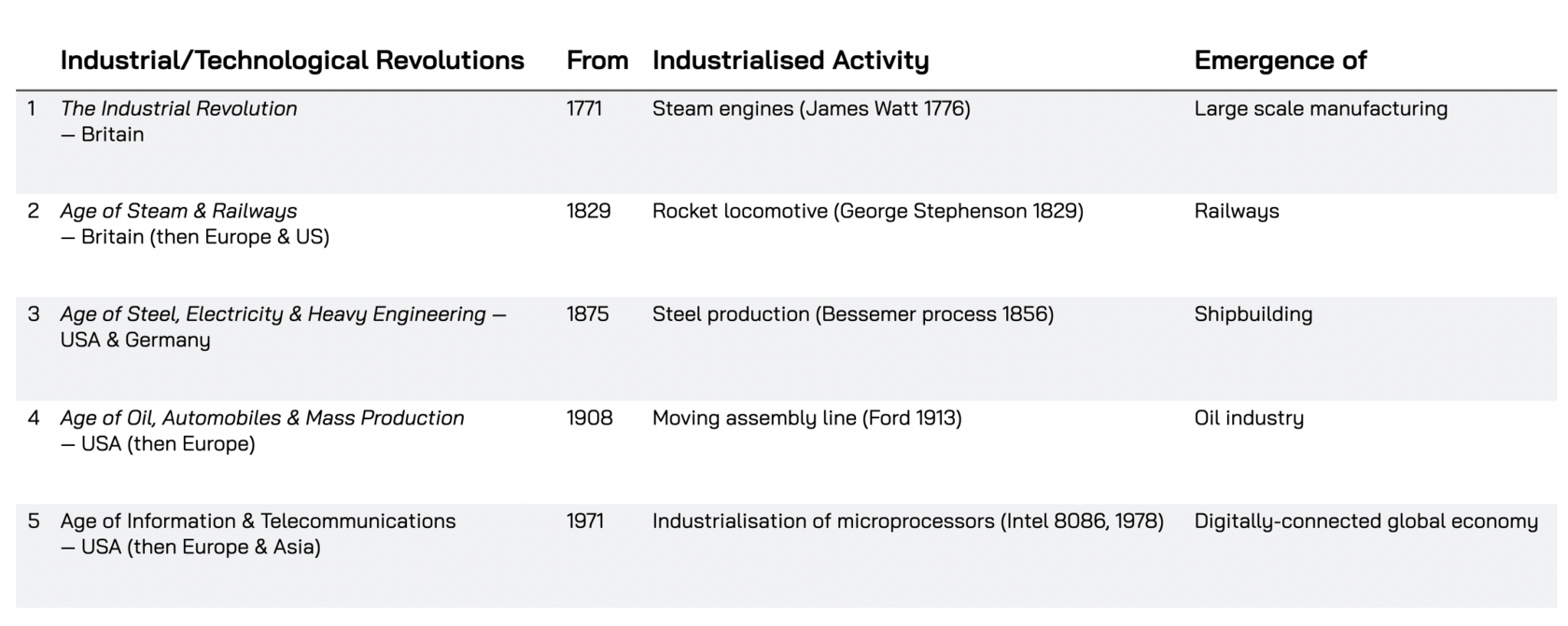

The final economic rule of the game described how the industrialisation of a key component triggers a kind of “war” — a systemic shift that compels everyone to evolve. The provision of a crucial activity as a widely-available, affordable and reliable utility-like service marks the dawn of a new industrial ‘age’. As outlined by Carlotta Perez (see chapter 22), such ages are not triggered by the initial appearance, or genesis, of a new activity, as there is still too much uncertainty when these first appear. It is, instead, the industrialisation of a set of inter-related components that together reduce costs, improve productivity and trigger radical innovation across all sectors.

For example, it was not the invention of the earliest known steam powered-device — the aeolipile by Hero of Alexandria in the first century AD, or even the first commercially successful steam engine by Newcomen (1712) that triggered the ‘Industrial Revolution’. It was the industrialisation of James Watt’s steam engine, following his partnership with Matthew Boulton (1776), together with other technologies the Hargreaves’ Spinning Jenny (1764) and Arkwright’s Water Frame (1769), as well as expanded access to capital via joint stock companies and public share offerings, that ushered in the first modern age.

Likewise, it was not the first known form of tracked transport — the Diolkos in ancient Greece in 600 BC — but the industrialisation of locomotives with George Stephenson’s Rocket (1829), alongside advances in coal mining and government-chartered joint stock companies for railway construction, that triggered the ‘Age of Steam and Railways’.

It was not the appearance of Wootz steel, used in Damascus swords in ancient India around 300BC, but the industrialisation and large scale adoption of the Bessemer process for mass-producing steel (1875) — together with Tesla/Westinghouse’s AC systems, global telecommunications, and vertically integrated financial institutions capable of funding entire value chains, from mines to railroads — that triggered the ‘Age of Steel, Electricity and Heavy Engineering’.

It was also not the early assembly line techniques in Venetian shipyards in the 12th century, but the industrialisation of the moving assembly line by Ford (1908) — together with Whitney’s interchangeable firearms, Taylor’s scientific management principles and the rise of mass consumer credit systems — that triggered the ‘Age of Oil, Automobiles and Mass Production’.

And it was not the Antikythera Mechanism — an early analogue computer used by the Greeks around 100BC to predict astronomical positions or eclipses — but Intel’s 4004 processor (1971 and especially the 8086 processor in 1978, which established the x86 architecture still dominant in modern computing), alongside the growth of the internet and the rise of venture capital firms as a funding model for high-risk innovation — that triggered the ‘Age of Information and Telecommunications’.

Fig. 142: Industrialised Activities Triggering the Five Industrial/Technological Revolutions

The industrialisation of a foundational activity triggers a wave of innovation — the ‘genesis’ of new activities — built on top of these now reliable building blocks. Nimble players, backed by financial capital looking for greater future returns, begin experimenting with new possibilities. Their growing success signals the destruction of the old ways of working — slowly at first, then suddenly.

We’re seeing this cycle play out again today. The first chatbot — Joseph Weizenbaum’s ELIZA (1966) — demonstrated that machines could respond using natural language. This concept has now been industrialised with today’s AI chatbots built on Large Language Models (LLMs), which is unleashing new forces of change.

When asked about these changes, Carlotta Perez replied15 that AI is a “very powerful revolutionary technology that can spur innovation across many sectors … and [is] likely to be part of the next (biotech?) one”. Just over 50 years since the start of the fifth ‘industrial/technological’ age, we’re standing on the threshold of the sixth — one where we know WHEN the transformation will happen (now), but not yet WHAT the outcomes will be, as they remain shrouded in uncertainty. How we can act effectively in such conditions will be the subject of part five of this book.

3 Strategy, Freedman Lawrence. p1080

4 Diffusion of Innovations. Everett M. Rogers, p14

5 Diffusion of Innovations. Everett M. Rogers, p17

7 I’m speaking here from the perspective of a European in 21st century Europe. This perspective may not be held as strongly by others and it would certainly have not been held by Europeans even a century ago.

9 Facebook, Amazon, Netflix, Google

12 This is something we explore in more depth in the next part.

14 Notable Douglas Parkhill’s 1966 book ‘The Challenge of the Computer Utility’ which articulated a vision for where computing resources would be provided as a utility service, able to be scaled up or down as needed similar to public utilities like electricity.

15 Shared in discussion with the author on X (April 2024).