It’s easy to fool ourselves into thinking that the way things are today is how they’ll stay tomorrow. But the only constant is change. Everything we do — and how we do it — is evolving all the time. Failing to recognise this can be lethal, as the Landscapes we operate in shift whether we want them to or not.

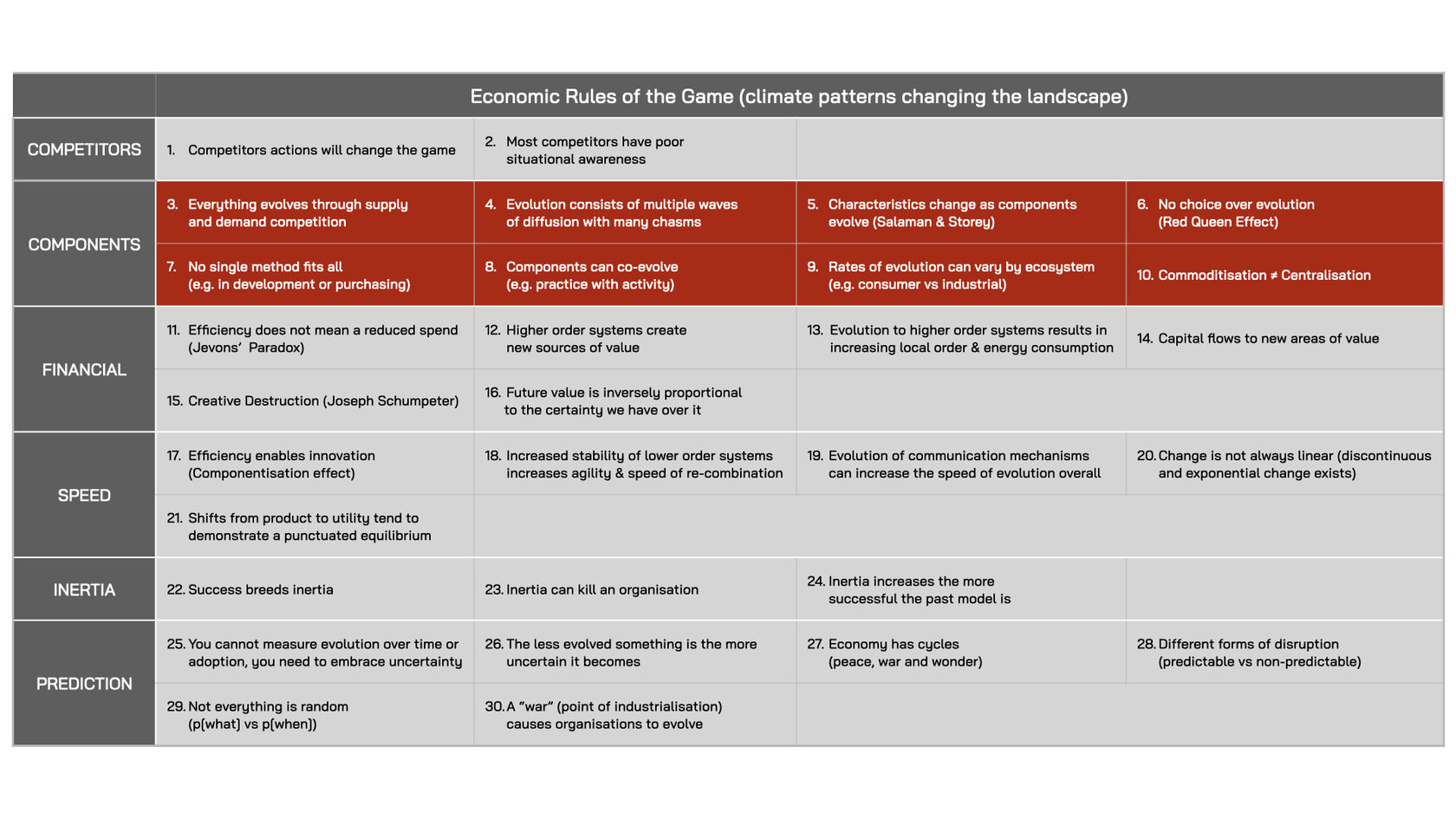

In this chapter, we’ll explore eight rules of the game that directly affect the components we use (the products and services we rely on from others) — and those we sell (our own products and services).

In this chapter, we’ll explore eight rules of the game that directly affect the components we use (the products and services we rely on from others) — and those we sell (our own products and services).

Fig.103: The Impact of Economic Rules of the Game on Components

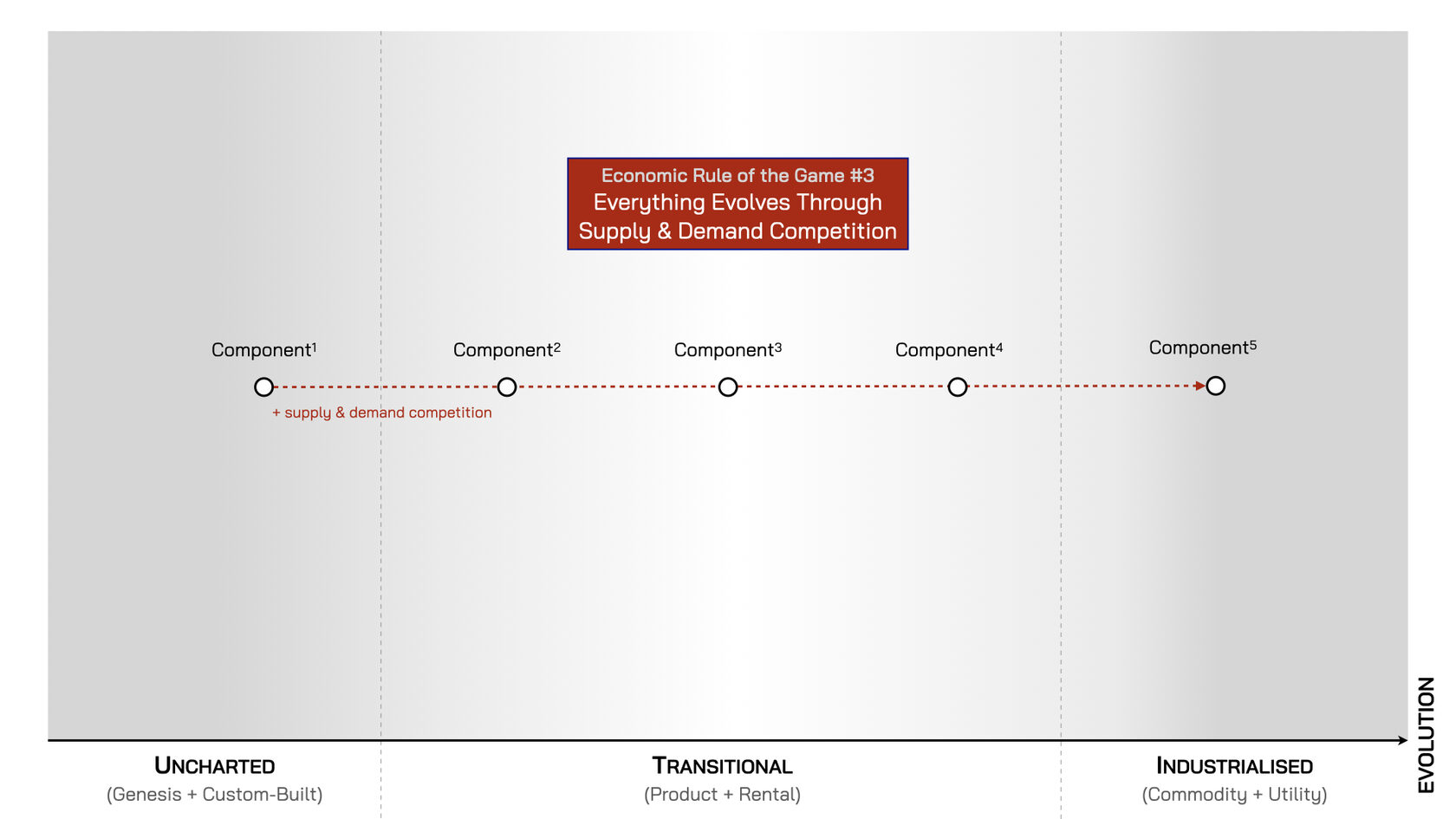

Rule #3. Everything Evolves Through Supply and Demand Competition

Markets consist of players competing for revenue, profits and market share by offering products and services that aim to satisfy user needs. If users find these useful they pay for them, meaning demand for the component grows. Attracted by the potential for increased revenues, other suppliers enter the market with their version of these components, thereby creating a competitive situation. This increase in supply puts downward pressure on prices, which in turn stimulates even greater demand.

To avoid a damaging race to the bottom on price, suppliers differentiate their products or services from those of their rivals, in an attempt to offer more value to users. This drives the evolution of components and we record this on a map by showing components moving to the right, driven by supply and demand competition.

Fig.104: Everything Evolves Through Supply & Demand Competition

However, not every component survives as some fail to find sufficient demand and fade away, as suppliers have no incentive to develop them further. The business world today is replete with examples of components that failed to get off the ground, but history is also full of breakthroughs that faded away and had to be ‘re-invented’. For example: “Mesoamerican societies never employed wheeled transport; but … they were familiar with spokes, wheels and axles since they made toy versions of them for children. Greek scientists famously came up with the principle of the steam engine, but only employed it to make temple doors that appeared to open of their own accord [and] Chinese scientists, equally famously, first employed gunpowder for fireworks1”.

Yet, if there is sufficient demand for a component, suppliers learn how to offer cheaper, better, faster versions. And eventually, what was once an uncertain, niche component in the ‘unchartered’ space on the left of the map becomes ‘industrialised’ as it enjoys widespread certainty in the market.

Rule #4. Evolution Consists of Multiple Waves of Diffusion with Many Chasms

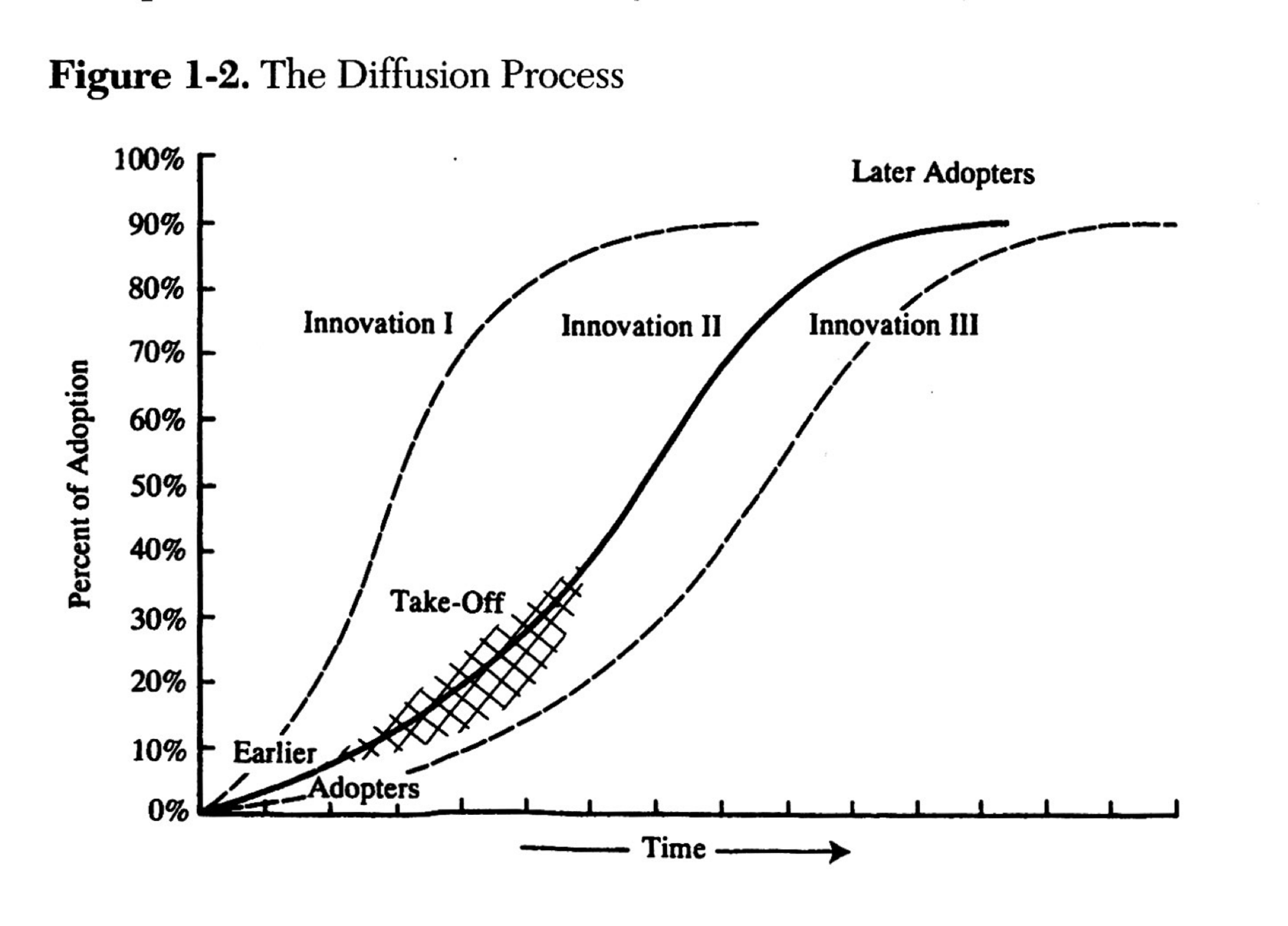

In his book, ‘Diffusion of Innovations’, Everett M. Rogers described how innovations — new ideas or technologies — spread, or diffuse through social systems. Diffusion begins with ‘early adopters’ — individuals or groups that recognise the potential in the new. If their experiments are successful and they’re influential in their community or market — for example, as opinion leaders — diffusion can accelerate. A tipping point is then reached and the innovation ‘takes-off’, with ‘later adopters’ also embracing the new.

However, not all innovations diffuse at the same pace, as it depends on the nature of the innovation and market readiness. Rogers, therefore, identified three broad diffusion curves: (I) for a ‘very successful innovation’ (II) a ‘successful innovation’ and (III) and a ‘moderately successful innovation’ (see fig.105). This work has become the standard way of underrating the diffusion of innovations in markets today.

Fig.105: The Diffusion Process (Everett M. Rogers)

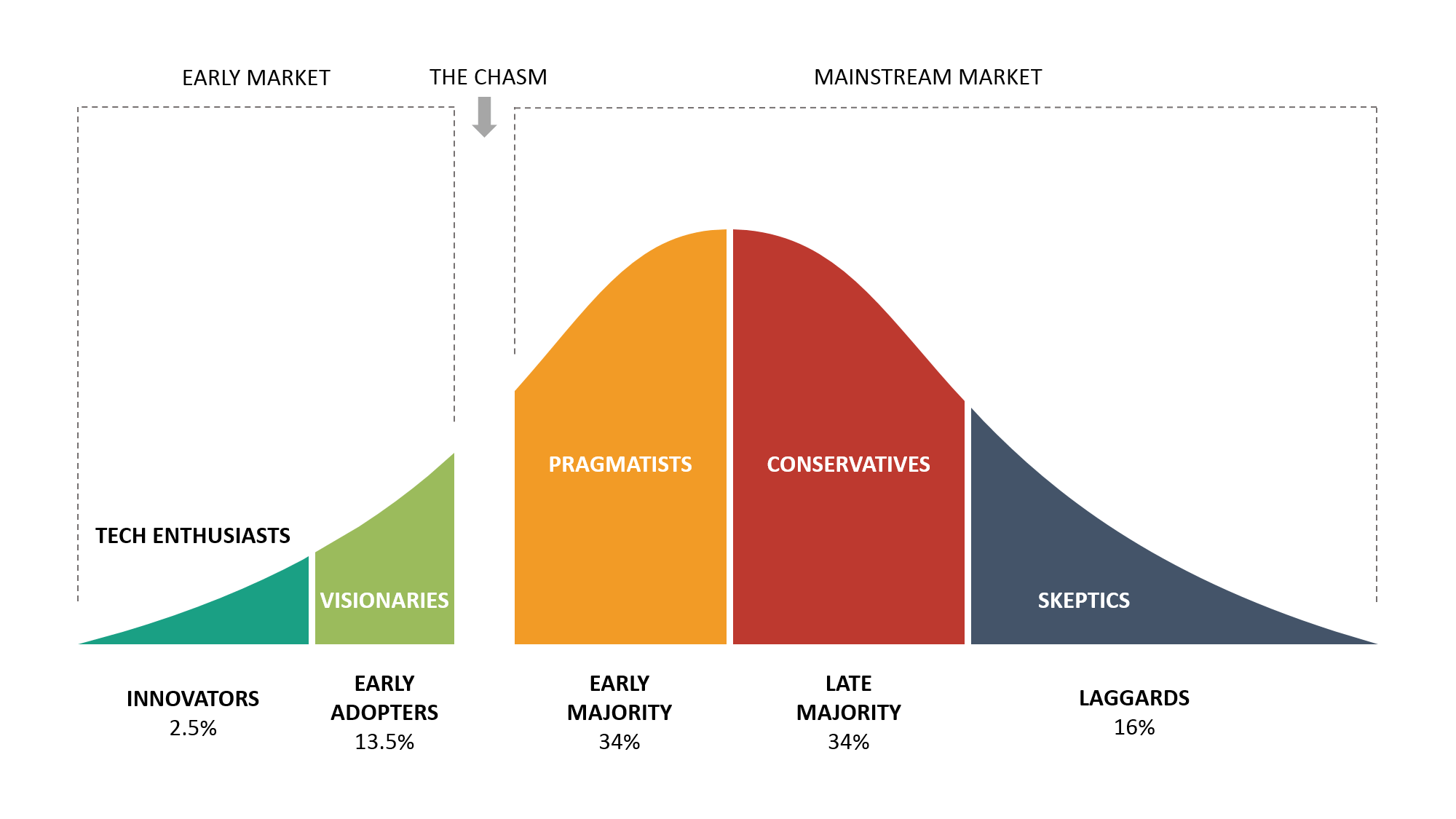

Another influential book, ‘Crossing the Chasm’ by Geoffrey A. Moore, focused on the critical ‘tipping point’ between the ‘early market’ and the ‘mainstream market’. Moore argued that new ideas and technologies diffuse by one group at a time, each representing a different share of the total applicable market (see fig.106):

- Innovators (2.5% of the population) — Tech Enthusiasts who seek out and embrace the new first

- Early Adopters (13.5%) — Visionaries who recognise the potential in the new and adopt it early

- Early Majority (34%) — Pragmatists who only adopt the new once they see widespread use and benefits

- Late Majority (34%) — Conservatives who only adopt the new after it has become well-established

- Laggards (16%) — Sceptics who only adopt the new reluctantly, when it has become unavoidable.

Moore suggested that innovations diffuse through “definable stages, each associated with a definable group”2 as the success of the earlier group influences the next group. Yet, he argued, the gap between the ‘early market’ and the ‘mainstream market’ is “so significant as to warrant being called a chasm”3. The pragmatists of the ‘early majority’ are not easily swayed by what visionary ‘early adopters’ do, as they see them as people who enthusiastically embrace anything new. But pragmatists need to see others like themselves achieve success with a new idea or technology before they make the leap. This creates a catch 22: the majority fail to adopt the new because no other pragmatists have adopted it yet. Hence why Moore argued that failing to cross the chasm is the most common reason for innovations failing to achieve widespread adoption.

Fig.106: Crossing the Chasm (Geoffrey A. Moore)4

The work of Moore and Rogers focused on the same thing, just from different perspectives: Rogers focused on diffusion through overall adoption, while Moore focused on diffusion through adoption by different groups. However, it’s not only demand-side diffusion — how components spread through populations — that matters. Supply-side evolution — or how components change — matters as much, if not more. CoVid-19, for example, diffused through populations as infections (a type of adoption), but it also evolved, with new, more infectious variations appearing that helped the virus spread. Diffusion and evolution are therefore related — one influences the other — but distinct concepts. Let’s explore why this matters with a history of the telephone.

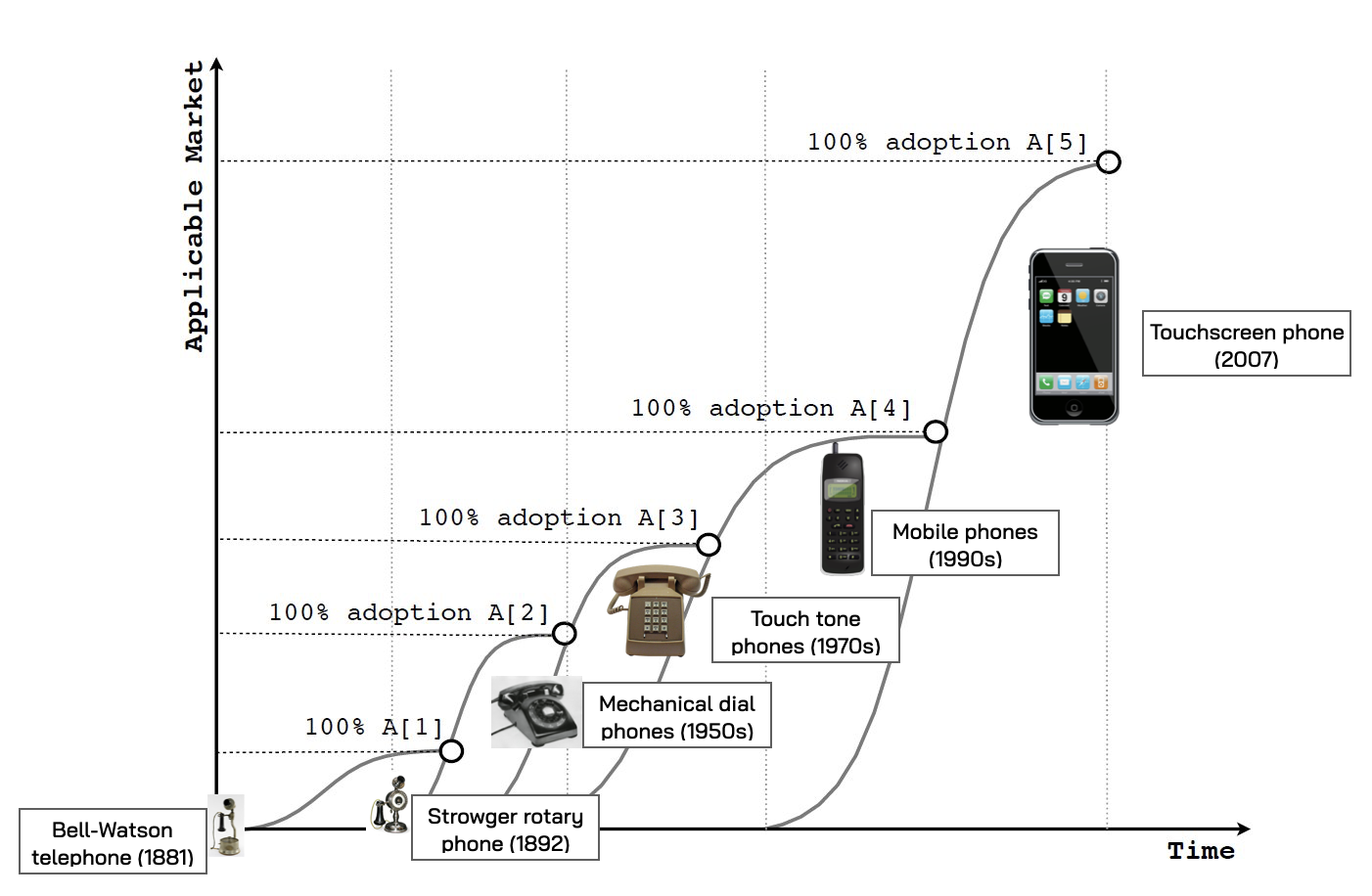

Making a call on the first commercially-available telephone, the Bell-Watson of 1881, required cranking a handle to alert an operator at a central exchange. This telephone then diffused first through early adopters, before crossing the chasm to its applicable market — those who could afford it, had social networks who could also afford it (so they had someone to talk to), and were located near to central exchanges. However, as the telephone diffused, it also evolved. In 1892, the first rotary dial phone was installed commercially, revolutionising how calls were made. This version also diffused through early adopters before crossing the chasm to its applicable market, which was now larger as improvements made the phone more accessible (one no longer needed to be near a central exchange), while there was wider-spread certainty about its usefulness.

Telephones continued to diffuse, but also evolve. Mechanical dial rotary phones became standard in households after World War II, followed by touch-tone dialling in the 1970s, mobile phones in the 1980s, smartphones in the 1990s, camera phones in the 2000s, and today’s touchscreen phones. Each iteration had to cross its own chasm — with pragmatists needing to see how others, like them, benefited from this new version before adopting it. Thus, it’s the evolution of a component — through improved capabilities and features — that expands the total applicable market of users able to adopt it, but evolution itself consists of multiple waves of diffusion with multiple chasms that the innovation must cross in order to survive and thrive.

Fig.107: Evolution of Telephones (Each Crosses Its Own Chasm)

Rule #5. No Choice Over Evolution (Red Queen Effect)

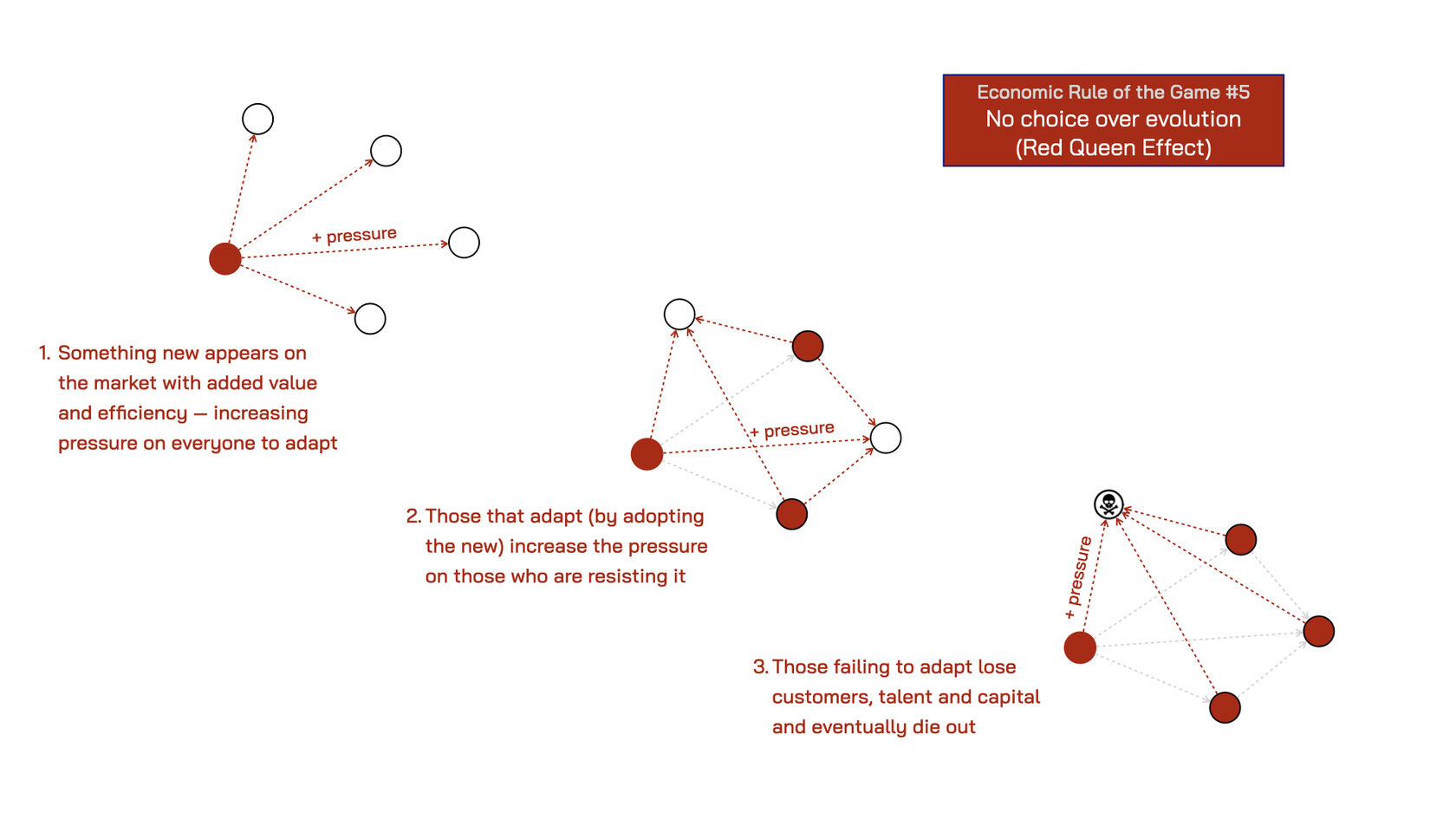

The business Landscapes we operate in are constantly changing due to the actions of other players, who seek to gain a competitive advantage over rivals by making their offerings more desirable to potential users. Yet, even when they succeed in this, their advantage is short-lived, as competitors quickly imitate them to secure their share of available revenues. This on-going competition drives the evolution of components (see rule #3 above) and leaves us with a choice whenever a new change appears on the market — adapt, or die5.

Biologist, Leigh Van Valen6, observed that every species struggles for survival in this way, with none immune from the threat of extinction. He called this an “evolutionary law” and named it after the Red Queen in Lewis Carroll’s ‘Through the Looking Glass’, who remarked: “Now here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”.

The ‘Red Queen Effect’ describes a type of “unorthodox game theory” in which every player is engaged in a never-ending zero-sum game. The rules are simple: you must continually adapt to each new value-creating innovation, not to win the game, but simply to stay in it. Failing to adapt means that even today’s winners can become tomorrow’s losers7 as “new adversaries grinningly replace the losers”. As dystopian as this game may sound there is an upside: the Red Queen prevents any player from dominating the game forever; which is why not all new cars are made by Ford today, and not all new touchscreen phones are made by Apple.

Fig.108: The Red Queen Effect

This relentless game of adapt or die drives innovation across a Landscape8, raising its overall efficiency and value. The game then continues, with players continually seeking ways to differentiate themselves further. When successful, their breakthroughs will again be adopted by everyone else who wishes to stay in the game.

Rule #6. Characteristics Change as Components Evolve

Most organisations recognise that, in this ever-changing Landscape, innovation9 is “critical for organisational competitiveness and survival”10. Yet, many adopt processes — such as annual budgeting cycles, rigid planning, OKRs and KPIs — that hinder their ability to innovate. Trying “to ensure that [they] never have a failure” renders many organisations incapable of experimenting, through multiple iterations of trial and error, that discovering new sources of value requires. This creates an ‘innovation paradox’ where: “the pressing need for survival in the short-term requires efficient exploitation of current competences and ‘requires coherence, coordination and stability’; whereas exploration/innovation requires the discovery and development of new competences and this requires the loosening and replacement of these erstwhile virtues”.

The innovation paradox causes internal conflicts with organisations. Those focused on the ‘business of today’ often view innovators with suspicion, accusing them of wasting their hard-earned profits on risky ventures with no guarantee of success. They see them as a threat to the ‘coherence, coordination and stability’ they have worked hard to build. Meanwhile, those focused on creating the ‘business of tomorrow’ criticise these colleagues for being stubborn and unimaginative, incapable of adapting to change. To overcome this organisations must become ambidextrous: being simultaneously capable of exploring the new while efficiently exploiting current conditions. This requires a rejection of either/or thinking in favour of both/and thinking — BOTH the business of today AND the business of tomorrow simultaneously. Having a map makes this easier.

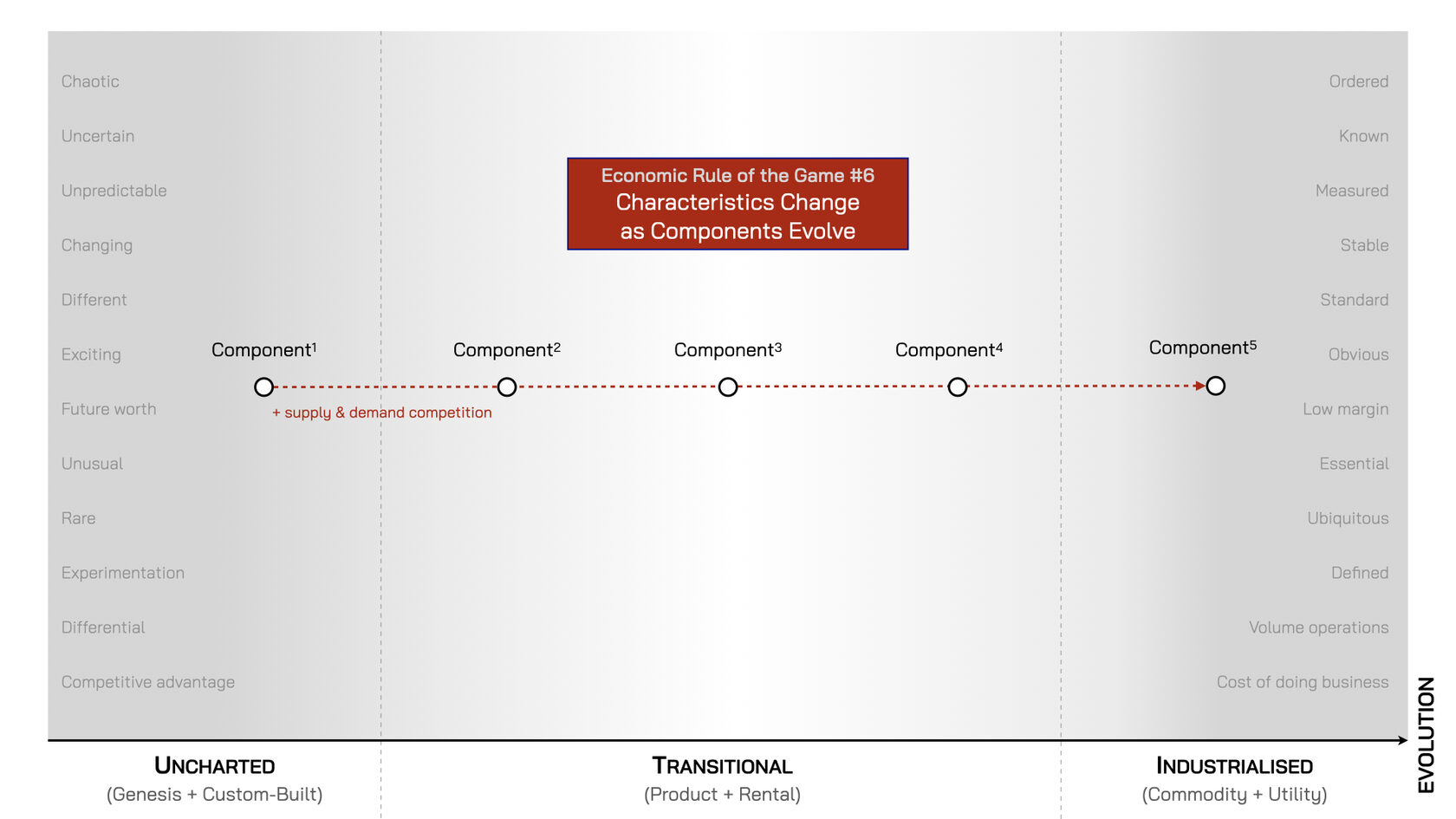

The map in fig. 109 (below), shows that components on the left of the map are uncertain and unpredictable but also exciting, as they may be potential sources of future worth. However, this will require experimentation. In contrast, components on the right are standard and stable, which makes them low margin. Yet, as they may also be essential costs of doing business, they can still be valuable as they could enjoy volume operations. Meanwhile, the characteristics of components in the middle of the map — those moving from left to right — are slowly transitioning from the unchartered and uncertain to the industrialised and known.

Fig.109: Characteristics Change as Components Evolve

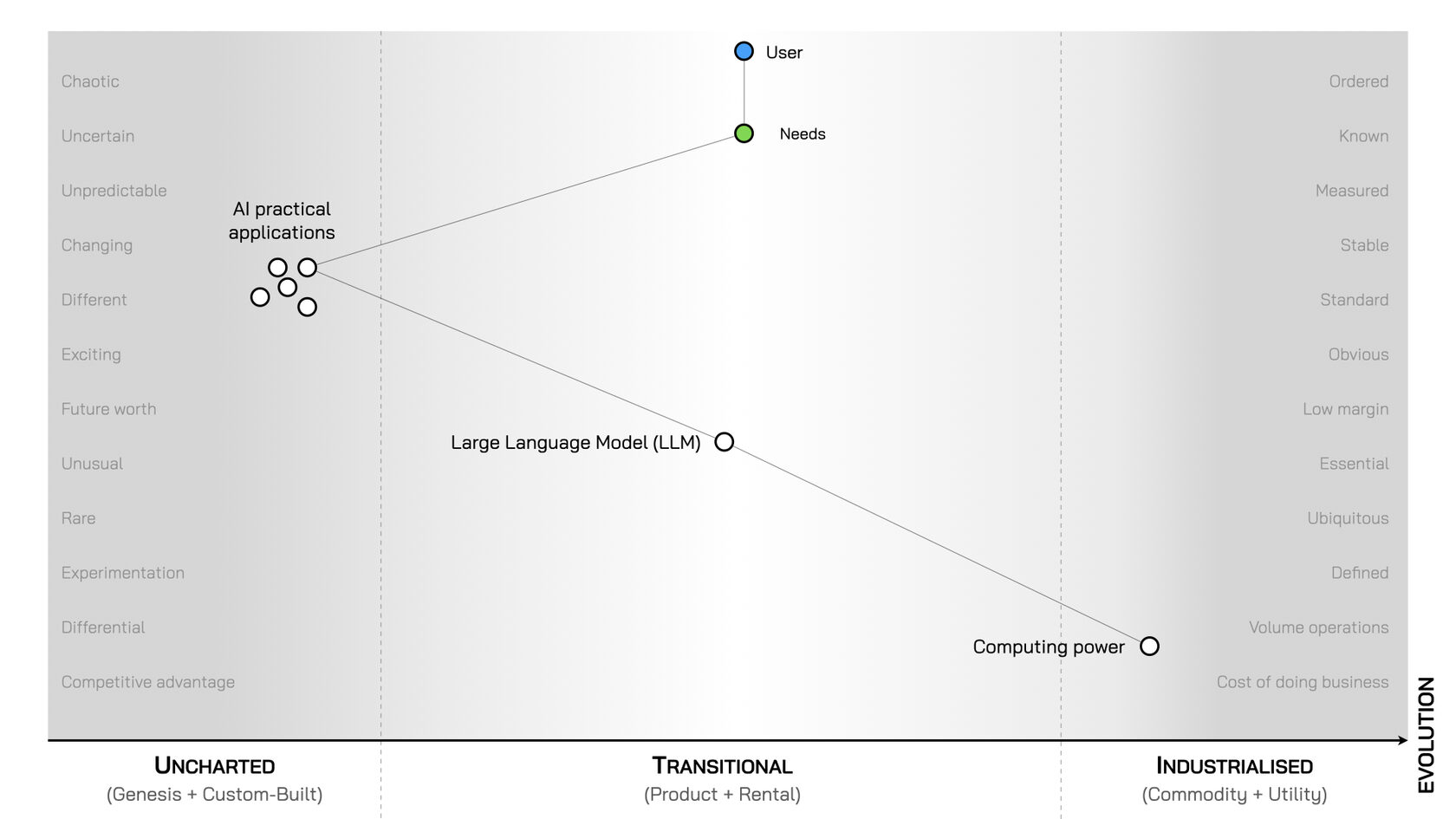

Every business, to varying degrees, has components spread across their map. For example, in fig. 110 (below), we see an organisation experimenting with innovative new components on the left of the map (‘AI practical applications’). However, this requires a sub-component in the middle of the map (‘LLM’), which in turn needs a further sub-component on the right of the map (‘computing power’). While innovators are experimenting with the new on the left, they need the components already created and managed by others in the organisation. Thus, far from being a relationship of tension — between those focused on the businesses of today and those focused on the business of tomorrow — this is a symbiotic relationship, with each needing the value created by the others if the organisation is to continue to survive and thrive.

Fig.110: BOTH the Business of Today AND the Business of Tomorrow

With a map makes this symbiotic relationship becomes clearer to all, helping teams understand not only their own roles better, but also recognise the importance of others for their continued success.

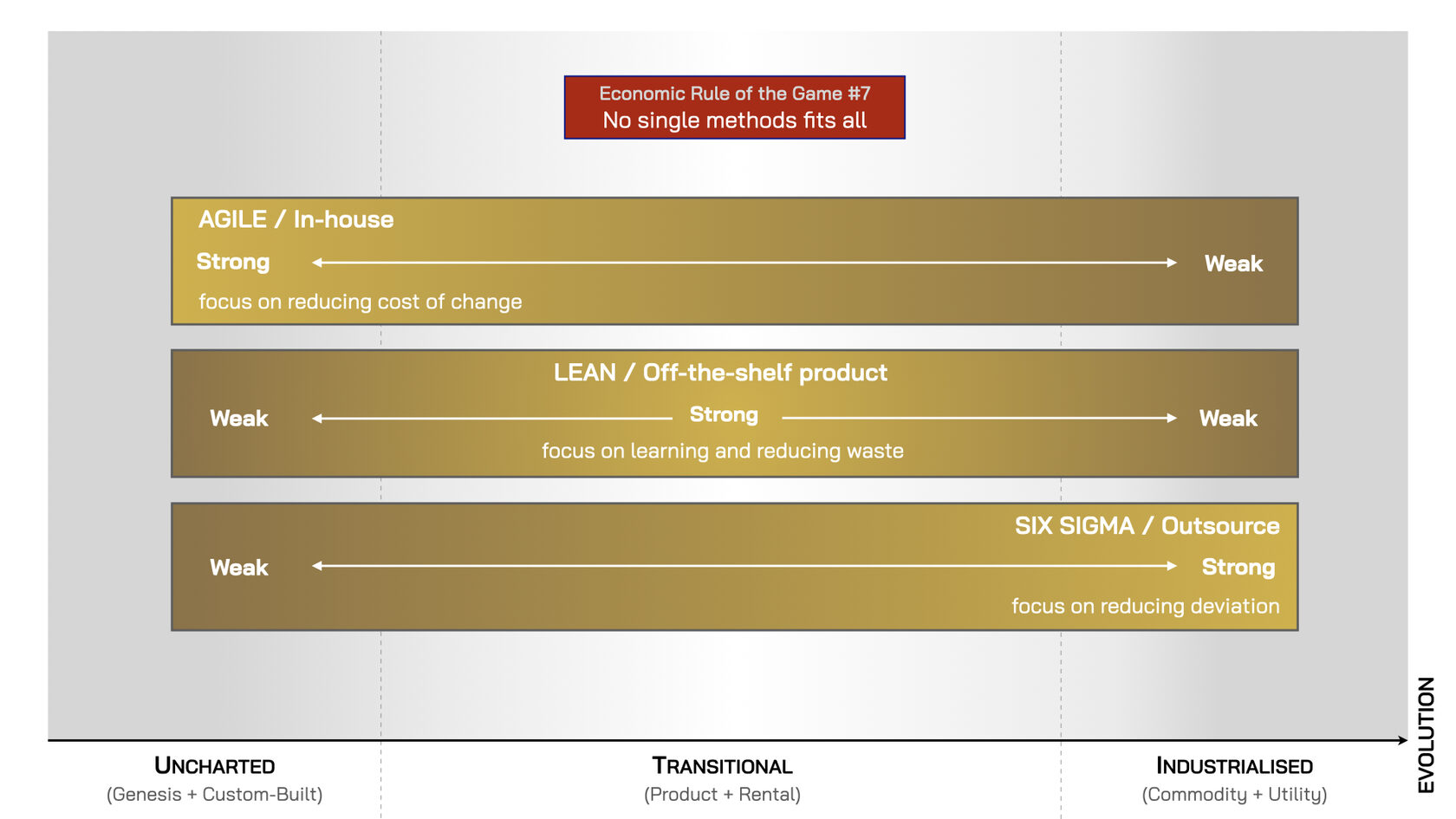

Rule #7. No Single Method Fits All

Once we recognise that the characteristics of components change as they evolve, and that an organisation has very different — even contradictory — components that need to be managed at the same time, we understand that no single method will work everywhere. Components in the industrialised space, on the right of the map, require methods that support the ‘coherence, coordination and stability’ of operations, such as ensuring the computing network runs smoothly so all teams can do their jobs. Methods like Six Sigma — which is strong at reducing deviation in performance — are beneficial here. Additionally, outsourcing sub-components to providers who offer pay-as-you-go services, such as electricity or cloud computing, also works well in this space.

However, applying one method everywhere, just because it worked somewhere else is a mistake, as the characteristics of components vary. Applying Six Sigma for components in the uncharted space on the left of the map would kill the organisation’s ability to experiment. In that space, methods like Agile — which is strong at reducing the cost of change — allow for the cost-effective, multiple experiments needed when building something new. While components in the transitional stage, in the middle of the map, where established products and services are found, benefit most from methods like Lean, which are great at increasing learning and reducing waste, thus improving product performance and profitability. Alternatively, any sub-components needed in this space (e.g. computers) can be bought commercially, off the shelf for fixed prices.

What works well in one part of the map won’t be effective in another part. Different methods are necessary, depending on the component’s stage of evolution. There’s no ‘one size fits all’ silver bullet solution, no matter how hard advocates may push their favoured approach.

Fig.111: No Single Method Fits All

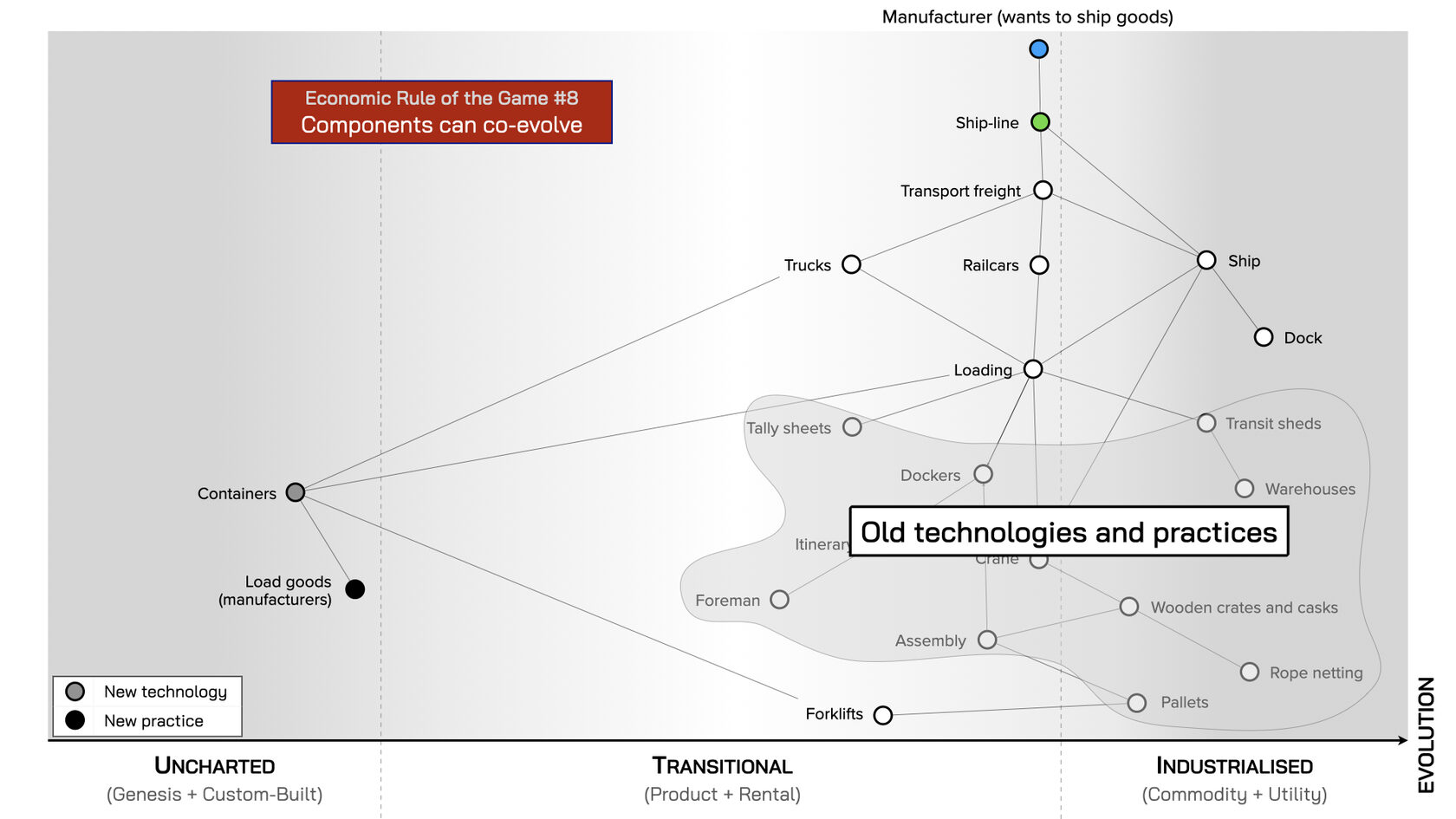

Rule #8. Components Can Co-Evolve

Carlota Perez, whose work we introduced in chapter 22, noted that “the development and diffusion of each technological revolution tends to stimulate innovations in finance and then to benefit from the impulse they provide11”. New technologies therefore don’t evolve by themselves. They create — and then benefit from — secondary effects, such as financing, but also new practices that help users exploit the potential of new technologies better. Therefore, it’s not only what we do that evolves, but how we do it as well.

Like new technologies, these new practices also evolve through a process of trial and error. They start as ‘novel or emerging practices’ with early promise, and if they consistently provide value, they evolve into ‘good practices’ that become more widely accepted ways of doing things. Eventually, they may become ‘best practices’ — ways of operating that cannot be improved on. Many common practices in organisations today — from accounting to manufacturing, marketing and HR — have co-evolved together alongside technological advancements. Excel spreadsheets are now a standard tools for creating budgets, just in time manufacturing for reducing costs, digital analytics for a more accurate evaluation of advertising impact, and continuous feedback replacing annual reviews with improved performance management systems.

The symbiotic relationship between activities (things we do) and practices (how we do this) reflects those in natural ecosystems, where species also co-evolve. Complex predator-prey relationships — where the survival of one depends on the other12 — echo the co-evolution of new technologies and practices, which trigger the development of yet more new technologies that require still more new practices, and so on. For example, advances in rocket technology triggered the need for new practices to manage the large complex projects involved in sending rockets and people into space. When these new project management practices spilled over to Boeing, who used them to build the first commercial jet — the 747 — this ignited the jet age and lead to new practices for industries like tourism and travel that evolved rapidly from this innovation.

The co-development of practices that help exploit the potential in new technologies is an essential driver of evolution. However, this also triggers a warning to organisations that fixate on ‘best practices’. For components on the right of the map that have become industrialised there will indeed be ‘best practices’ for managing these that can’t be improved on — such as connecting your office to the electricity grid in order to outsource your power needs and only pay for what you use. But mistaking ‘good practices’ (which work today but are still evolving) for ‘best practices' can led to organisations clinging to outdated technologies. This attachment to the old can prevent them from experimenting with the new technologies ‘emerging practices’ are co-evolving with, thereby limiting their ability to adapt to a changing world quickly or effectively enough.

Fig.112: Co-evolution Of New Technologies (Containers) With New Practices (Manufactures Loading Goods)

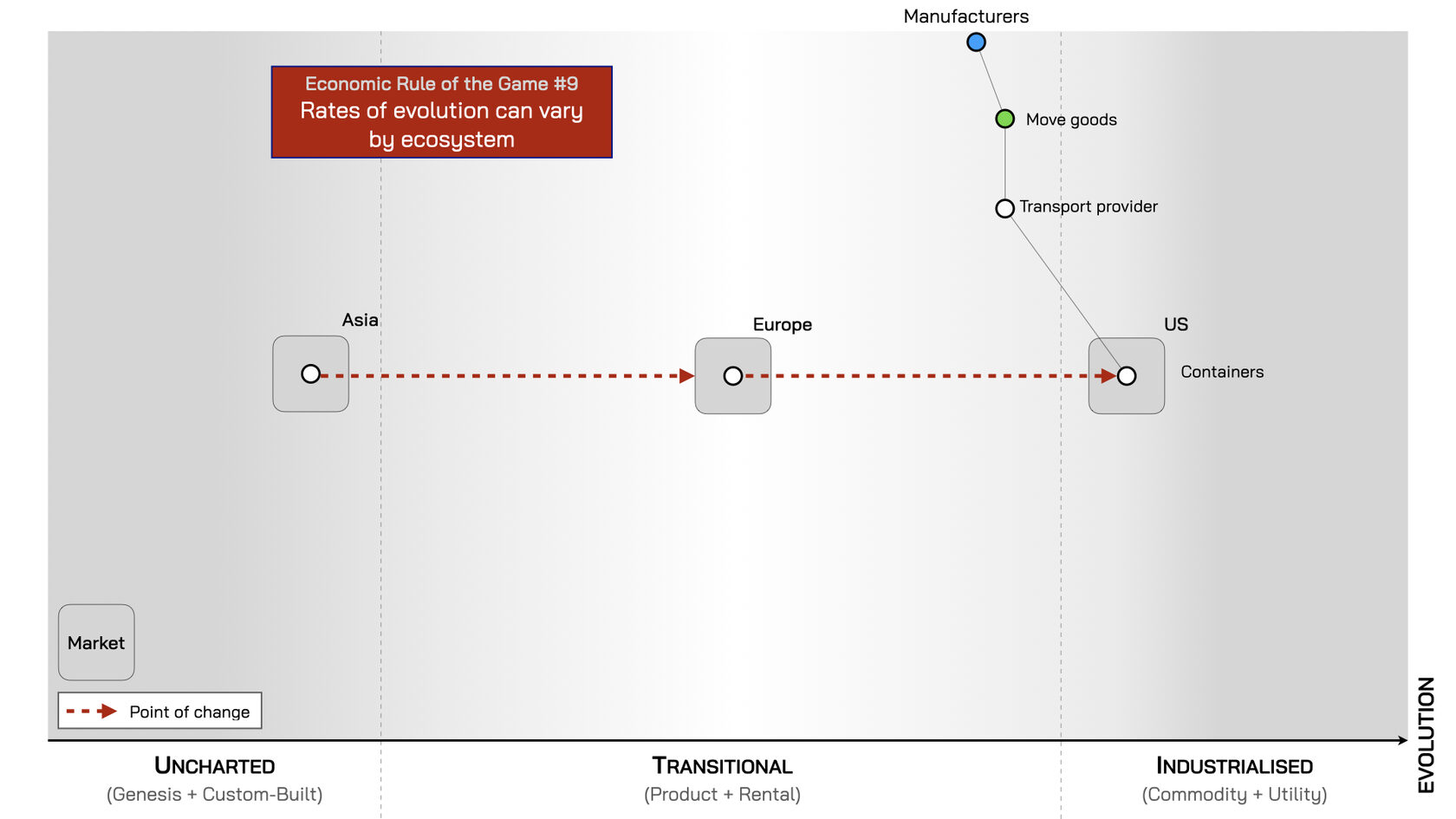

Rule #9. Rates Of Evolution Can Vary By Ecosystem

The speed at which components evolve can be glacial, particularly in B2B (business-to-business) industries. People making decisions for the entire organisation often fear the personal consequences of getting things wrong, such as a reprimand or dismissal. As a result, they tend to stick with the tried-and-tested so they can deflect responsibility if anything goes wrong (“we did what everyone does in our industry — it’s not my fault”). This cautious approach slows down the rate of evolution, as there’s less incentive to experiment with the new.

In contrast, the speed of evolution tends to be much faster in B2C (business-to-consumer) industries. Here, buyers typically make decisions for themselves, meaning the personal risks of making the wrong choice are relatively smaller. The lower level of risk makes B2C customers more willing to try new things, which accelerates the process of learning as the feedback consumers provide helps suppliers improve their offerings, which increases the rate of evolution in these industries13.

Evolution rates also vary across different geographical markets, where the same component will be more evolved (i.e. widely-understood and used) in one location over another. For example, by the 1970s, containers had become a standardised component in the US transport and logistics ecosystem, widely-adopted by shippers, truckers and railroad operators. This gave rise to new practices, such as inter-modal transport and increased automation, which further industrialised the practice of using containers.

However, at this time Europe lagged behind the US as European nations tended to trade primarily with each other or former colonies, resulting in less competition and less stimulus for change. Additionally, coordinating the activities of multiple governments to pass the legislation needed to enable the wider use of containers across the continent proved challenging. In Asia, containers were even less evolved, as the majority of international container traffic was shipped between two most prosperous continents, US and Europe — although this would undergo dramatic changes in the following decades. If we mapped the evolution of containerisation in the 1970s by geographic markets, it would look like this:

Fig.113: Evolution of Containers By Geographical Markets (1970s)

The map in fig.113 illustrates that, if we had been transporting goods globally in the 1970s, we would have encountered few difficulties in the US as containers were industrialised and common practices for moving goods in them would have been widespread. In Europe, however, we would have had to ’shop around’ for suppliers who could provide similar services at reasonable prices. While in Asia, where containers were largely an uncharted component, we would have struggled to find suppliers at all and would have likely had to explain what we needed in detail and negotiate contracts from scratch.

This map would have also indicated to Europeans and Asians the future direction their markets would likely take (unless obstacles were constructed by government action or, in the case of containers, government inaction). The US market was showing other markets where they were heading in future — echoing William Gibson’s famous quip that: The future is already here, it’s just unevenly distributed.

Rule #10. Commoditisation Does Not Mean Centralisation

The final economic rule of the game about components concerns ‘commoditisation’. It’s important not to confuse this term with ‘commodification’, which refers to the transformation of social activities into commercial ones (e.g. turning babysitting for family and friends into a paid activity). As a commercial activity it will evolve through supply and demand competition, (e.g. the emergence of more reliable babysitters) until it eventually becomes standardised and indistinguishable on the market (e.g. the provisions of always-available robot babysitters). This final step is ‘commoditisation’ — the transition from a differentiated activity (reliable babysitters) to an undifferentiated service (robots following the same identical babysitting protocols).

However, commoditisation — the standardisation of an activity — doesn’t not automatically lead to centralisation, with a single player dominating the market. Anti-monopoly legislation typically prevents this by ensuring multiple players can compete within a tightly regulated market, which helps maintain price stability and service reliability. This was the comfortable club shippers in the post-war period were members of; having traded some independence — giving up control over routes and pricing — in exchange for government contracts and subsidies. For the government, this structure ensured competition, prevented a single player from becoming too powerful, and maintained a standardised fleet they could commandeer in times of war.

Choice builds resilience into a system -- if one player fails, others can quickly step in. Government can also use its influence strategically, setting challenges for members of the club (e.g. mandating investment in more modern ships) and rewarding those who do so, (e.g. granting lucrative new routes). However, if centralisation goes too far — concentrating excessive power in the hands of a single player — government can intervene to break up emerging monopolies. Thus, centralisation and de-centralisation can be a form of strategic gameplay14 that powerful institutions, like governments, can use to achieve their desired outcomes.

1 The Dawn of Everything. Graeber & Wengrow. p240

2 Ibid p10

3 Crossing the Chasm, 3rd Edition: Marketing and Selling Disruptive Products to Mainstream Customers. Moore, Geoffrey A. P6

6 A New Evolutionary Law. Leigh Van Valen (1973)

7 See chapter five — Innovating Out of a Crisis for the example of Kodak, who was the leader in its market globally, failing to adapt effectively to changes in its core market.

8 Unless there are artificial obstacles, like a patent , which can stop a new innovation spreading, making it less valuable and hampering the ecosystem’s development.

9 Like strategy and culture, innovation is one of those words widely used in the business world, but lacks a common definition, which often leads to miscommunication and misalignment. This can be overcome by recognising that there are multiple types of innovation: from something entirely new to the world (far left of a map), to something new to your market (moving towards the centre), to sustaining and disruptive innovation (in the centre) and business model innovation (on the right).

10 All quotes in this section are taken from ‘Managers' Theories About the Process of Innovation’ by Salaman and Storey an article in the Journal of Management Studies (March 2002)

11 Technological revolutions and financial capital — the dynamics of bubbles and golden ages. Carlota Perez p94

12 For example, the absence of prey threatens the survival of predators, who rely on them for food. But the absence of predators from an ecosystem can threaten the survival of prey as their unchecked population growth can lead to a deterioration of their ecosystem that struggles to maintain them: https://www.youtube.com/watch?v=ysa5OBhXz-Q

13 For an exploration of how to exploit the connection between learning and rates of evolution strategically, see chapter seven — Time as a Strategic Weapon

14 We explore ‘gameplays’ in part four.